Break out of Market Conventions and Succeed in Usage-Based Insurance

Insurance telematics and usage-based insurance (UBI) programs continue to roll out across the globe. With a rapidly changing competitive landscape it’s increasingly difficult to select the correct business models to ensure success. In fact, many programs are starting to look alike – with a focus on price discounts resulting in an inevitable race to the bottom. With the entire industry moving in this direction, only a subset of companies will succeed. Your organization has an opportunity to stand out from the crowd. The key to success is a differentiated and targeted program. IMS UBI Intelligence enables auto insurers to create uniquely targeted programs based on your needs and objectives. Our solution is based on an agile, end-to-end platform that enables speed to market without sacrificing flexibility to create programs targeted at your policyholders.

Why IMS UBI Intelligence?

IMS UBI Intelligence delivers on the promise of being the premier, most complete UBI solution, offering a one-stop shop for an insurer’s UBI needs – no additional suppliers or multiple partners to work with.

Our key differentiators

Insurance Telematics Solutions Options

Insurers can now boost profitability by tailoring their program strategy to each customer and product in their portfolio. IMS UBI Intelligence provides a wide range of solution options for all types of program and segmentation needs:

Data-Agnostic Collection Options

As the only true data source agnostic solution on the market, we work closely with you in choosing the right technologies to adopt to ensure you achieve your growth goals and potential. We make the whole process of a successful launch as simple and easy as possible.

Sensor Overview with Pros & Cons

Smartphone/ SDK Option

Use of mobile as sensor, either through white label app or SDK in 3rd party app

- No-cost deployment and improvements in data integrity make this the most viable option for mainstreaming insurance telematics

- Drives high levels of customer engagement via feedback apps

- Operates completely independently to the vehicle and circumvents intrusion by OEMs

- Can be deployed via bespoke apps or SDK into 3rd-party apps

- More easily ‘game-able’ by the user to mask behaviors without an app misuse solution (Contact IMS for more details)

Self-powered Tag/Beacon

Mounted Bluetooth wireless device tethered to app

- Low cost deployment and known data integrity make this an attractive option from light-touch to mainstream connected propositions

- Has high-fidelity collision detection capture within the device to aid with post collision claims handling

- Easy self install for the customer, and captures journey data even if the mobile is not in the vehicle

- Easy self install for the customer, and captures journey data even if the mobile is not in the vehicle

- No FNOL if the mobile is not in the vehicle at the point of collision

- Battery life is limited to approximately 24 months, and requires replacement for following years

OBD

Dongle plug-in for OBD port

- Only aftermarket device that can access CAN bus data, offering vehicle status data and prognostics

- Ubiquitous in European & North American markets for insurance and fleet

- Ease of self-installation (in some cases)

- No current success in the UK insurance market due to inaccessibility of OBD port

- Lack of consistency of data across vehicle makes/models if not correctly normalized by TSPs platform

- Faces an uncertain long-term future due to OEM threat: European OEMs lobbying to restrict 3rd party access; many ports block data transmission once over 30mph

- End user installation complexity including ease of locating port

Black Box

Installed box

- Standardization of data harvested from the device across all vehicles

- High-fidelity collision detection and robustness of data helps claims remediation and boosts loss ratio performance

- Theft detection and stolen vehicle recovery a key benefit for carriers and mobility operators, and can be positioned as an adoption driver for consumer propositions

- No access to CAN bus data

- Relevance may be limited long-term if OEMs manage to align around useful connected car data standards that are commercially viable

- Not a consumer applicable hardware option for North American market and other regions of the world

- Had additional complexity and expenses including time and effort for professional install of hardware into vehiclePotential

OEM / Connected Car

Direct feed / line fit from on-board computer

- Potential to provide access to embedded sensors and a wealth of additional lines of data analysis, such as ADAS systems

- OEMs are realizing the potential to monetize data for their own and 3rd party provider benefit – insurance is the key use case

- Challenge around standardization of data protocols across all makes/models to make scoring unilaterally applicable as OEMs not agreeing on a standard – requires TSP to solve for with a platform based solution (Contact IMS for more details)

- Uncertainty around timeline for ubiquity, and no clarity around likely cost of data to 3rd parties

- Many manufacturers still concerned about data ownership and privacy

- Challenges around consent management not ubiquitiously being solved for by OEMs

Customization and Flexibility Options

IMS UBI Intelligence offers an unmatched solution that will help ensure the success of your program in today’s competitive marketplace.

Telematics Insurance Risk Scoring Customization

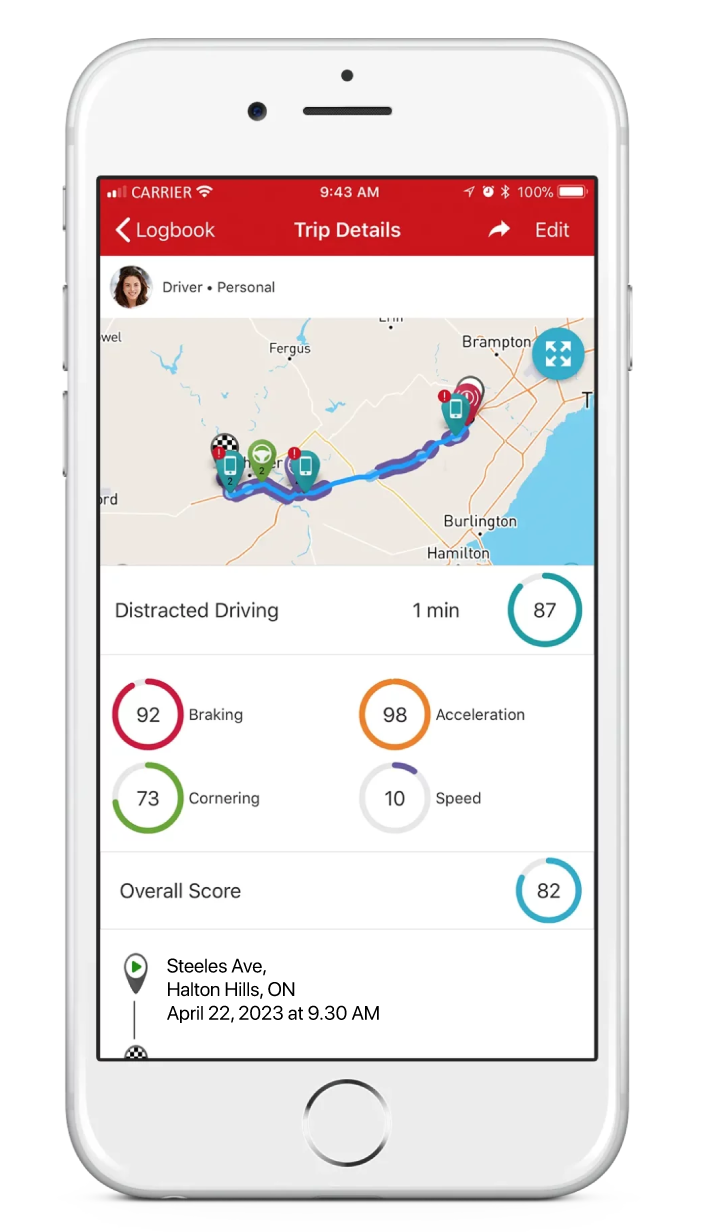

Create customized scoring for both vehicle and driver with a suite of scoring variables while keeping the safety of your policyholders front and center.

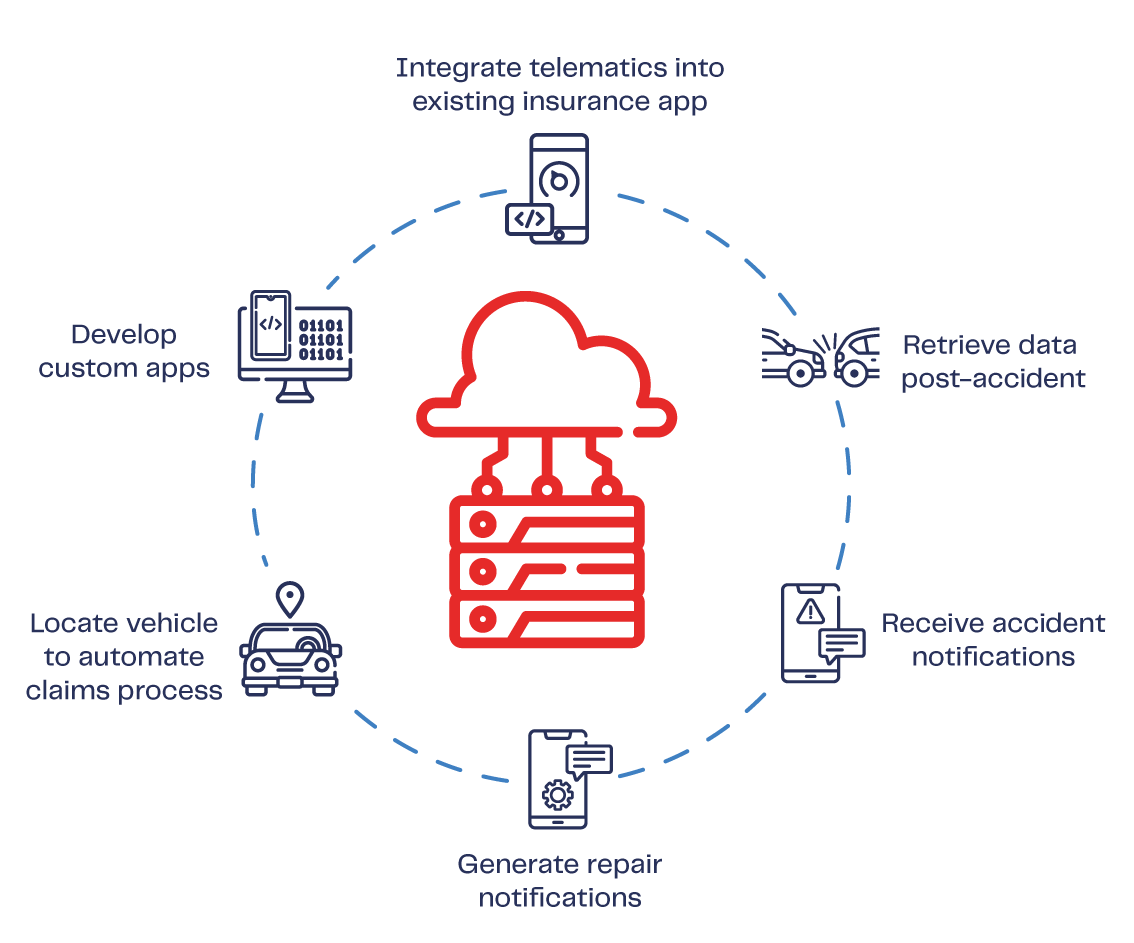

API Integration

Unleash the power of a comprehensive suite of interfaces that allows you to create differentiated solutions based on your strategy and target market. Build highly differentiated, bespoke solutions or leverage our reference applications to get to market quickly.

Secondary Driver Option

Give policyholders the flexibility of viewing driving data of secondary drivers to promote safer behavior. You also benefit from the ability to design differentiated programs targeted at new segments, such as multi-driver families, new driver coaching programs and car sharing.

Flexible Scoring and Rating

Flexibility is key to a smooth big data and analytics journey. We offer full flexibility in scoring and rating to precisely assess risk for each policyholder and encourage safe driving.

The right scoring and rating for your business.

Flexible Options:

Create a scoring and rating model leveraging any of three methods:

- IMS’ internal analytics teams.

- Your existing actuarial models refined by IMS.

- IMS’ analytics partners.

Unique Rating Systems:

Create differentiation through a unique scoring system.

Expanded Scores:

Leverage a selection of scoring variables for your algorithms.

Scoring UX:

Display scoring and events in an easy to understand experience for policyholders.

IMS UBI Intelligence Components

For Auto Insurers

The tools you need to manage and administer a successful UBI program.

For End Users

One deployment, using the IMS DriveSync® platform, can support both sides of your insurance business – personal lines and commercial lines users.

Benefits for auto insurers

- Increase loyalty of current policyholders & attract new customers

- Generate revenue via value-added services

- Lower risk, cost and claims

Benefits for drivers

- Personalized auto insurance premiums

- Increased driver education & improved driving skills

- More awareness for better preventative maintenance

Learn more about our leading end-to-end UBI solution

Contact us to request for more information