Why Shift to Commercial Insurance Telematics?

Commercial lines insurers are quickly adopting insurance telematics in order to fully realize the benefits telematics offers and restore profitability over more traditional models that have been delivering poor underwriting results. Due to adverse loss frequency and severity trends, including those caused by distracted driving, combined ratios for commercial insurers have risen to over 100%. In fact, combined ratios were 101.8%¹ in 2020 with an estimated 5 year outlook of 101.5%². This has resulted in global insurance premiums increasing year over year to 11%³ as of Q1 2022. As a result, in order for insurers to stay profitable, steep rates increases have become inevitable, much to the dissatisfaction of their fleet customers. In turn, in order to afford commercial premiums, fleets are playing with the numbers, such as insuring with larger deductibles and distributing risk and cost across a wider safety net to achieve a better cost.

¹ https://www.insurancejournal.com/news/national/2021/11/15/642259.htm

² https://www.spglobal.com/marketintelligence/en/news-insights/research/us-pc-insurance-market-report-personal-commercial-auto-fortunes-flip

³ https://www.insurance-canada.ca/2022/05/04/marsh-global-commercial-rates-continue-moderate/

IMS Commercial Usage-Based Insurance Solution

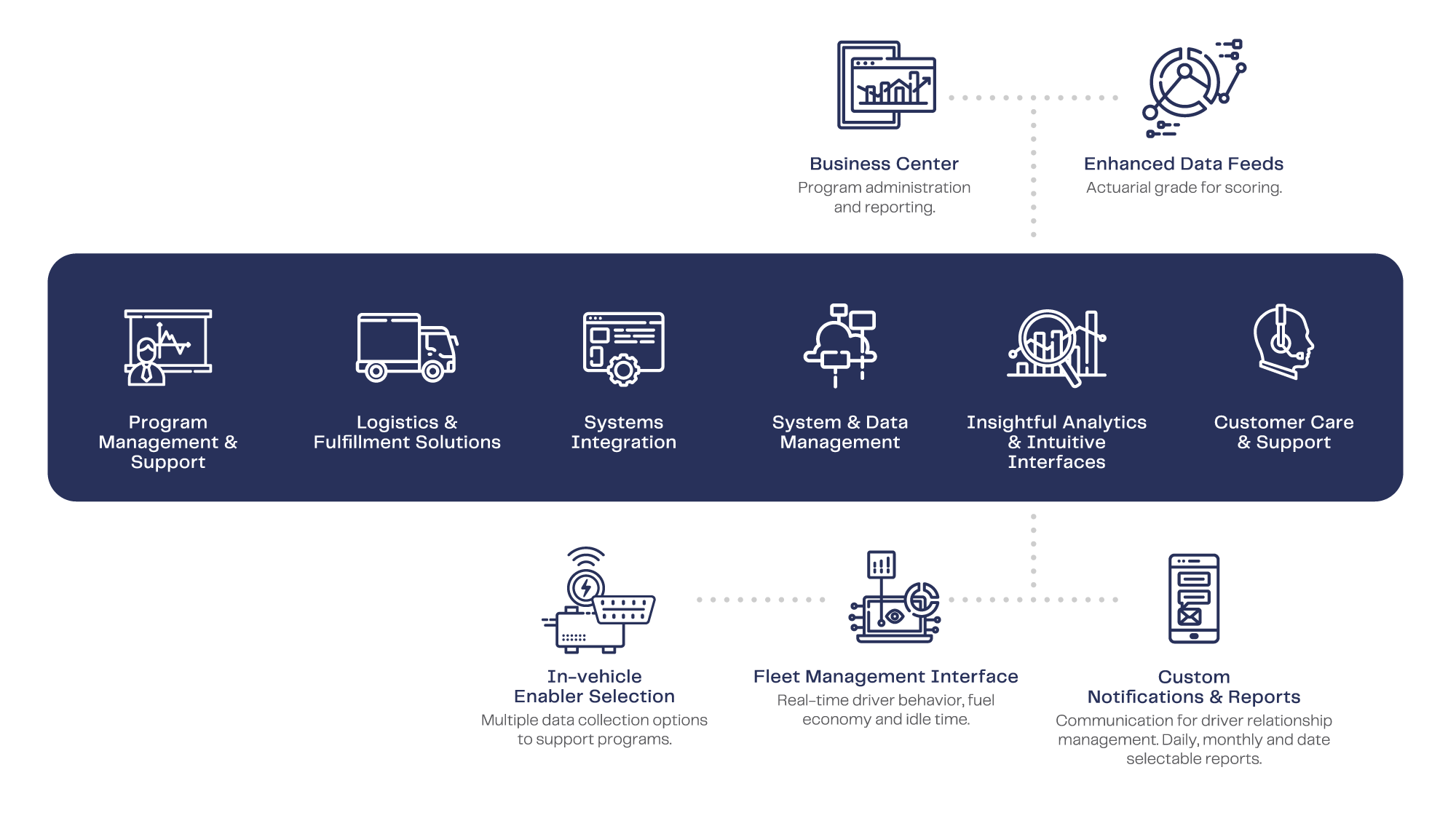

IMS Commercial Usage-Based Insurance (CUBI) provides commercial lines insurers with the industry’s most comprehensive solution satisfying the needs of the insurer, fleet manager, and fleet driver alike. Commercial insurers finally have the proper tools to engage, retain, and assess fleet risk for improved pricing and rating and to help ensure a profitable book of business. Fleet managers have the ability to improve fleet driver behavior and realize cost savings at every stop along the way – all while paying the commercial premiums most accurately associated with their fleet risk. In turn, fleet drivers get regular real-time feedback and insights to continuously improve driving behavior and, appraise, and reward performance and safety.

IMS CUBI provides insurers with the ability to improve profits by encouraging safe and distraction-free driving behaviors. Studies conducted in the United States show a 20% reduction in fleet accidents when telematics monitoring is in place. In Europe, this number climbs to 28%!

Key Features – For the commercial lines insurer

Optimize the performance, safety and cost of your fleet customers.

*IMS Business Center – For Insurers

Key Features – For Fleet Organizations

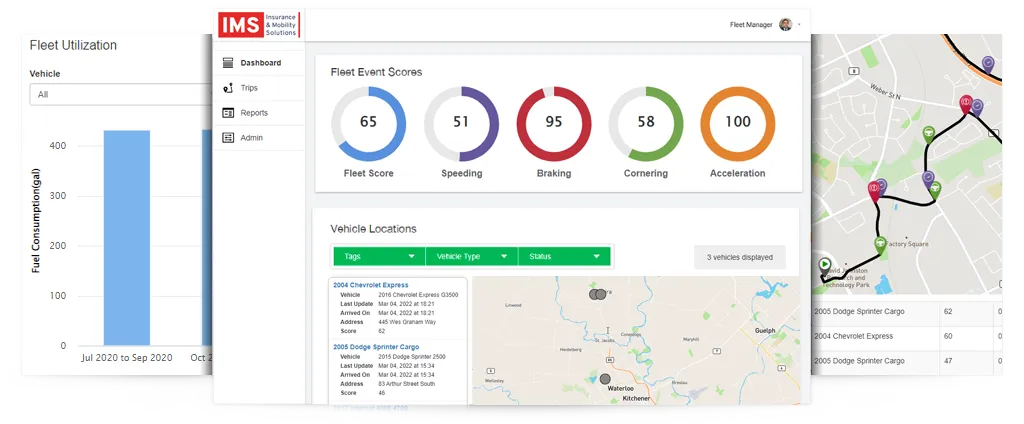

*IMS CUBI Portal – For Fleet Organizations

IMS Commercial Usage-Based Insurance Component

IMS Commercial Usage-Based Insurance, powered by IMS DriveSync®, provides everything insurers need to manage and administer a successful commercial insurance telematics, and includes a fleet behavioral portal for fleet owners.

Benefits for Insurers

Explore IMS Commercial Insurance Telematics In More Detail

Commercial Usage-based Insurance

As a form of commercial insurance telematics, commercial usage-based insurance (UBI) has quickly become a popular topic with commercial insurers and fleet organizations alike. It enables commercial insurers to reward safe driving practices with policy premium discounts – helping to acquire new fleet customers while retaining more profitable book of fleet business.

Scoring and Rating

Flexibility is key to a smooth big data and analytics journey. IMS CUBI offers full flexibility in scoring and rating to precisely assess risk for each policyholder and encourage safe driving.

The right scoring and rating for your business:

- Flexible Options: Create a scoring and rating model leveraging any of three methods:

- IMS’ internal analytics team.

- Your existing actuarial models refined by IMS’ internal analytics team.

- IMS’ analytics partners – Willis Towers Watson | Verisk Analytics.

- Unique Rating Systems: Create differentiation through a unique scoring system.

- Expanded Scores: Leverage a selection of scoring variables for your algorithms.

- Scoring UX: Displays scoring and events in an easy-to-understand experience for policyholders.

Learn more about IMS Commercial Usage-Based Insurance

Contact us to request for more information