Meeting The Challenges: Claims Experience

There’s no denying that the insurance landscape has rapidly changed. The digital age has given insurers new tools for determining who, and what, represent the greatest risks and costs to their customers and their bottom line.

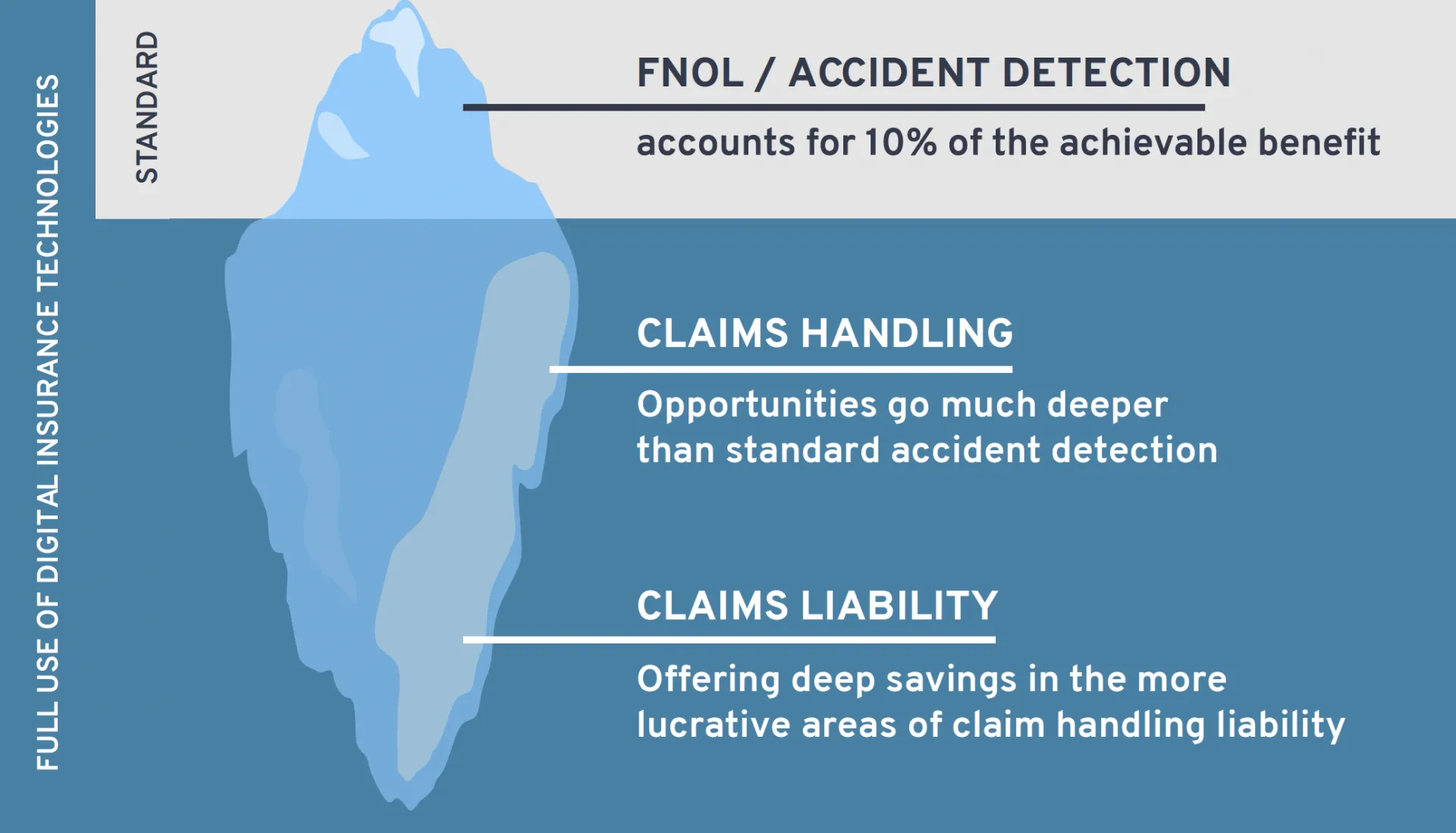

Consumers want quicker underwriting and claims experiences. Senior-level insurance executives recognize the importance of digitalizing auto claims as a top priority. But too many Insurers are fixated on crash detection and missing the bigger picture of what is truly possible. What is your organization doing to improve the claims experience and bring claims costs under control?

Solution Overview

How to Evaluate Your Competition

Your claims management process has a unique place in determining your competitiveness as an insurer.

Presenting IMS Connected ClaimsTM Telematics Solution

IMS’ Connected ClaimsTM telematics solution is a low-cost suite of telemetry-based services that transforms collected telematics data into appropriate analysis that positively impacts the policyholder experience and an organization’s claims costs. IMS’s Connected ClaimsTM solution includes ongoing training and implementation consulting, along with expert support services.

With over 10 years of global experience in claims telematics programs, IMS’ use of telematics data poses the best and most economical entry point into your claims digital transformation journey – at an area of affordable cost and immediate ROI to your existing claims operation. An investment of 2% of premium expense in IMS Connected Claim’sTM proprietary technology is enough for an auto insurer to unlock a claims quantum benefit of more than 6% – and without requiring any FNOL change of process!

IMS’s Connected ClaimsTM telematics solution goes beyond accident detection leveraging telematics data to reduce claims costs in two additional claims costs areas: liability and handling – which together deliver 80% of the overall benefit to your organization:

- Claims Liability ROI: including validation and analysis of data and compelling evidence to help identify fraudulent and/or inflated personal injury claims.

- Claims Handling ROI: including intervention; more accurate liability decisions; and shorter claims shelf life.

- FNOL ROI: including early accident detection and alert service; instant control over recovery and remediation; and improved duty of policyholder care.

Featuring Claims as a Service as another component of the solution, experienced members of the IMS team will provide expert witness services (including court attendance as needed) and training of in-house teams coupled with our proprietary Telematics Technical Statements.

Best of all, because the IMS Connected ClaimsTM solution sits within the market-leading IMS DriveSync® platform, insurers can quickly and easily develop this initial claims solution into a fuller suite of services across your book of business – including rewards and engagement, safe driving, analytics and scoring and more.

What’s Included: IMS Connected ClaimsTM

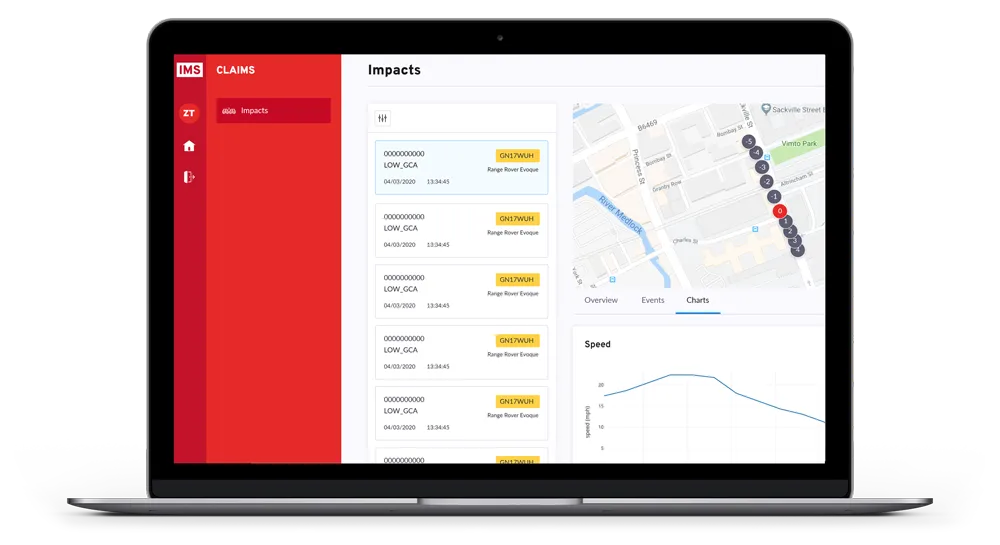

See How it Works

Claims Technical Statements

Making telematics data easy for claims handlers

Technical statements form a unique and important part of IMS’ Connected ClaimsTM professional service component known as Claims as a Service (CaaS). Technical statements encapsulate the core insights from captured telematics data, and with the help of our CaaS claims experts helps insurers realize the following benefits across all telematics claims:

- Telematics data is compiled into one straightforward report that enables a claim to transition smoothly from FNOL into a full claim.

- The Technical Statement provides claims departments with a full clear summary of the telematics data and claim.

- IMS will work with your claims teams to ensure they can confidently use telematics data and technical statements when handling telematics claims.

- Technical Statements can be shared with third party insurers, solicitors and police as part of the claims process and to bring clarity to the data.

- Leveraging technical statements within claims processes has proven to deliver loss ratio benefit to our insurer partners.

Request an In-Depth Sample of Our Technical Statement to See How These Benefits Can Work for You

Why IMS – Long Experience in Crash Detection

- Data source agnostic so you can address any segment in your book of business – mobile app-only solution, app + Wedge combo.

- Claim Process co-design meaning we work with you to integrate the new tools within your existing claims process to maximize your loss ratio improvements.

- Expert consultancy services with over 10 years experience assisting everyday claims data-usage training, consultancy, and assistance, including liability evaluation, damage assessment and Lawsuit and Court support.

- Powered by IMS DriveSync®, future proofing your ability to offer additional usage-based connected insurance programs along with engagements and rewards tools to optimize your ROI and program success.

- Best-in-class accident detection rates – see our Facts and Figures below.

Facts and Figures

IMS Connected ClaimsTM Solution

Contact us and learn how to leverage telematics data to cut claims costs