Drive Deeper Loyalty and Enhance Your Business Performance

Frequency of engagement is one of the key elements that has been missing from many telematics programs. Forward-looking insurers are increasingly recognizing that frequent, high-value engagement—as often as daily—can be combined with other incentives to accelerate the adoption of telematics programs.

The tools and techniques for successful engagement can be the hidden key to unlocking the full range of opportunities provided by telematics programs and attracting drivers who respond to incentives with genuine value. Through responsive, regular communication with policyholders and the right mix of engagement modes, insurers can break down the barriers to wider adoption of telematics-based UBI programs and increase their market share.

Does your insurance telematics program drive the necessary on-going behavioral modification that results in:

- Lower claims costs,

- Double digit COR improvements,

- On-going customer retention and

- Better overall revenue and profit for your business?

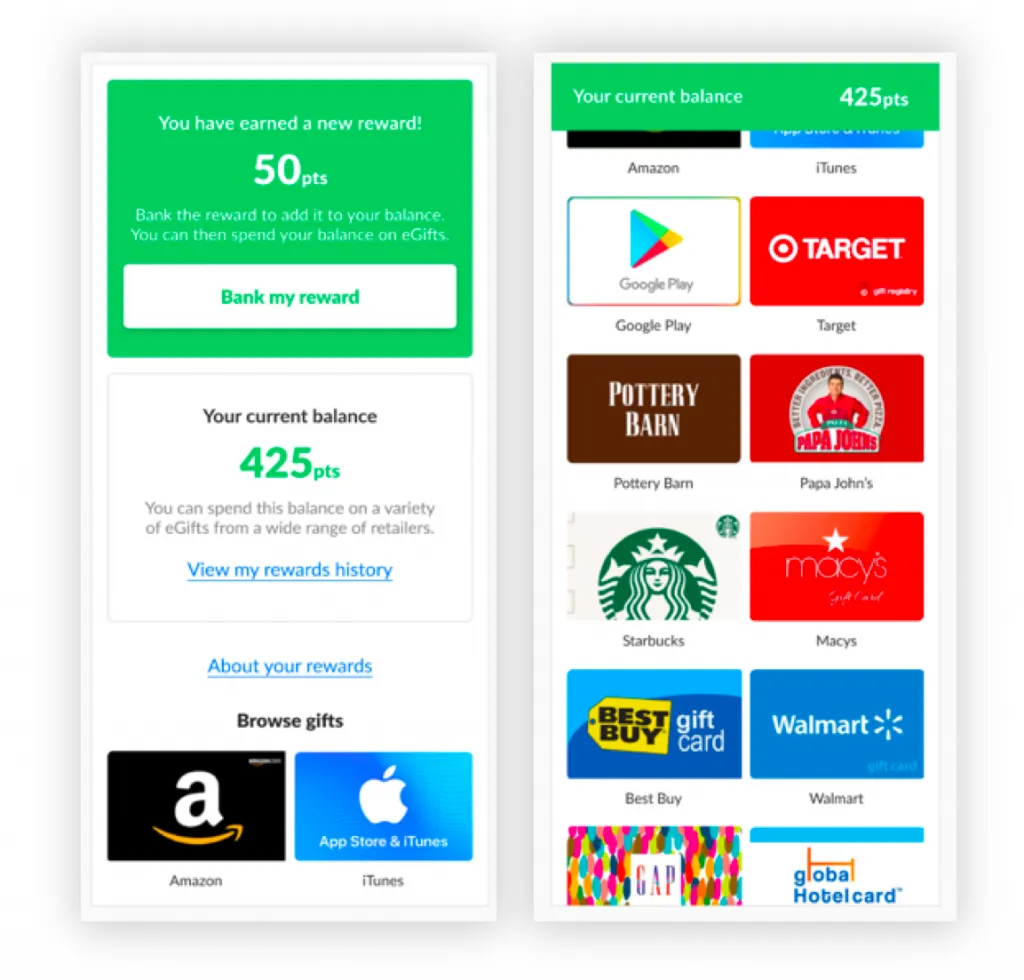

The IMS Engagement ToolsetTM

The IMS Engagement ToolsetTM is the industry’s most comprehensive suite of engagement tools and techniques that leverages telematics data and is proven to modify driving behavior and drive desired business outcomes to drive down loss ratio values.

- Uniquely available to any insurer looking to introduce a rewards and engagement program

- Works with any existing insurance telematics program including:

- New programs

- Existing in-house programs

- Existing programs built by another vendor

- Also works with your existing rewards scheme and prizes

- Provides the definitive glue that binds driving behavior to measurable program outcomes

- Built upon the tried and proven rewards and engagement success based on our experience running a direct-to-insurance insurance arm – making IMS the only technology partner with direct to consumer expertise and proven insurance telematics know-how

Don’t Bet on Inexperience

If done wrong, engagement and rewards programs will just become a significant cost to your program.

Only IMS has solved this widely acknowledged industry challenge, along with the data and experience to back it up.

IMS Engagement ToolsetTM and Features

The toolset will be available as a managed service via IMS, or through a self-service portal, where customers can configure, combine and customize multi-layered messaging and rewards campaigns themselves.

The Only Tried and Proven Reward and Engagement Platform in Market

Work with IMS to achieve these similar outcomes as realized through 10 years of B2C experience running a direct to consumer insurance company:

Learn more about IMS Engagement ToolsetTM

Contact us to request for more information