Approaches designed to increase engagement can be delivered efficiently through a proposition often presented through a smartphone app—that enables drivers to access, compare, and benefit from the program. Retention and customer loyalty are by-products of the efforts made to deliver on the promise of expectations being made to the customer.

In many cases, the most direct and consistent communication portal to reach the customer is a smartphone interface, given that smartphones are something consumers already engage with daily. The app can consolidate the features and benefits of the program, giving drivers a convenient daily dashboard to view the status of their driving record, see progress toward earning incentives, receive real-time feedback, and maintain an active channel of engagement with the insurer.

Some insurers are building up entire ecosystems around telematics, featuring rewards such as a free coffee at a gas station in recognition for good driving behaviour. Driver feedback and coaching through apps and/or insurance web portals are also powerful tools for the insurer to positively influence a policyholder’s driving habits. The increases the interaction and the perceived value for the customer. ¹

Swiss Re Group

The following capabilities have been shown to generate a positive response from drivers. These are often more effective when used in combination.

|

Rewards and redemption |

A way to incentivize safer driving by providing tangible, regular rewards keyed to driver performance or usage. |

|

Gamification |

The use of friendly competition and enjoyable gameplay to encourage driving skills and customer loyalty |

|

Communication nudges |

Personal real-time alerts to drivers when their behavior is deemed unsafe or reckless, delivered through a smartphone or console |

|

Personalized driver feedback |

Coaching applies telematics data to detect patterns |

Rewards and redemption

As an incentive to better driving practices, rewards can be crafted to meet driver expectations matched against desired behavior outcomes and provide attainable and satisfying redemptions to reward safe driving habits. Weekly, bi-weekly or monthly rewards can be an effective way of increasing engagement regularly, requiring that drivers meet certain performance criteria to obtain their rewards. Rewards can include gift cards, affinity relationships (such as car washes, gas discounts, or auto detailing), merchandise, coffee and meals, and even branded merchandise or other items.

Insurance Revenue recommends, “While you can spend a lot of money on rewards, your perks don’t have to be expensive. Tailored correctly, your loyalty program expenses will still be lower than the marketing costs incurred when you acquire a new customer.” A side benefit of a rewards program, beyond retaining existing customers, is that customers may share details about redeemed rewards with others, increasing the visibility of your brand.”

To develop a successful rewards program, insurers need to consider two main factors:

- Rewards should be attainable on a regular, frequent basis to keep drivers alert, engaged, and accountable

- Rewards should be something that drivers genuinely value, ideally linked to their demographics and preferences

A program that fails to address these factors will likely cause drivers to quickly lose interest or feel as though the rewards are not worth the bother of changing driving behavior.

Gamification and recognizing personal achievements

Feedback, positive reinforcement, and communication all go into the mix to encourage drivers to pay attention to best practices and sharpen their driving skills and safe performance when on the road. Gamification can provide a degree of engagement with customers that is fulfilling, rather than threatening or unwelcome. With some imagination and creative game features, insurers can overcome communication barriers and inspire customer satisfaction.

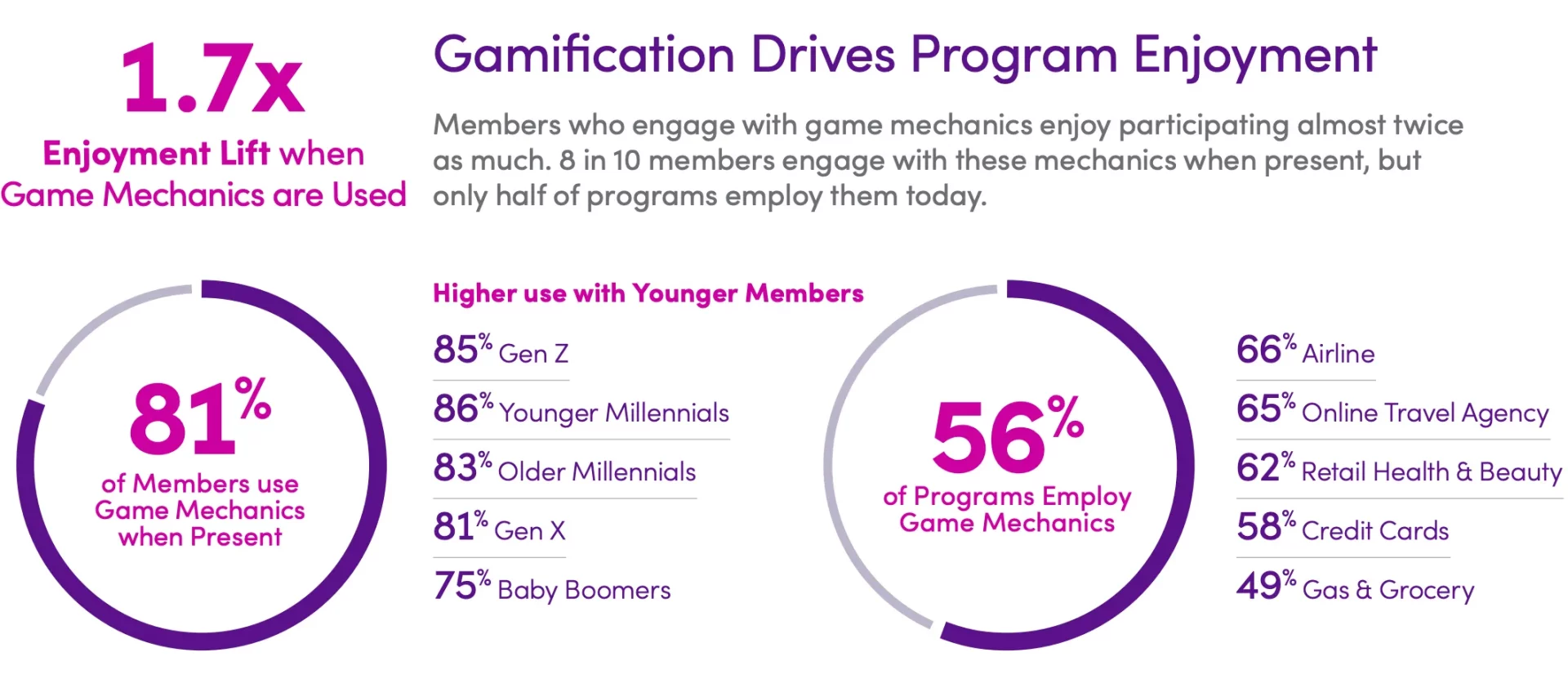

Based on a comprehensive survey of brand loyalty and engagement by Bond, Hubspot revealed that loyalty program participants had a 1.7 times enjoyment lift when game mechanics were included in the membership. Gamification was shown to be the number two driver of member satisfaction. Through gamification, insurers can venture beyond basic claims service or competitive premium costs to forge a deeper, mutually beneficially policyholder relationship built on imaginative, innovative ways to connect to the brand’s offerings. Similar kinds of mechanisms, such as the ability to obtain badges for certain levels of achievement or to have the performance of top drivers displayed on a leaderboard, have been shown to prove rewarding and motivating to customers.

Leaderboard models showing results in an ongoing, time-based competition among many participants can also assist in acquiring and encouraging adoption of recently launched programs. Leaderboards can help launch marketing initiatives during the life of a program, as well.

Figure 1. Interest in gamification²

Communication nudges

A communication nudge, performed in real time or at the end of a trip—informing the customer that an unsafe or ill-advised driving maneuver has been detected—can often encourage a quick change in behavior. The communication delivered to the customer should be forthright and firm, making it clear that safety and accident avoidance are essential to maintaining good standing with the insurer. Other real-time or near-time notices can be delivered to drivers, such as policy status, usage statistics, or other relevant information.

Personalized driver feedback

A proven method for providing advanced driver training and simultaneously reducing claims to insurers, drivers respond positively to the benefits of coaching paired with telematics. By identifying the underlying causes of unsafe driving and using instructional technology and actionable recommendations to improve behavior, accidents and incidents can be greatly reduced. For example, in studies conducted by Aite Group, among youthful drivers (who present the highest risks to insurers), those drivers that go through regular coaching reinforced by telematics data had a reduced frequency of accidents averaging 28 percent up to 49 percent. The study also showed that traffic violations were reduced by 54 percent up to 67 percent.³

Predictive data analytics can be applied to measure the impact of driver feedback and real-time guidance—in terms of accident frequency and loss ratio effects—giving insurers another useful tool to manage claims based on real-world data provided by telematics.

Using an integrated approach

Ideally, these engagement modes do not stand on their own. Instead, they are combined and merged to find an optimal package that balances better driving behavior with maximum value for the driver. Insurers have an opportunity to differentiate themselves in a competitive market by rethinking what their customers really need in a meaningful way and devising programs that spark interest and engagement in a fresh and compelling manner. Often the only sustained contact customers have with their insurer is during a claims incident and if that experience and contact is positive and memorable, the customer is likely to form a closer bond with the insurer. The real-time capabilities of telematics to communicate details rapidly and accurately in response to incidents can be an important factor in strong customer relationships.

Bain & Company suggests that insurers compensate for the low-touch nature of their business by building loyalty through ecosystem services. “With ecosystem services, insurers can engage with their customers more often and, in the process, build sustained relationships with them. Instead of simply providing accident and theft coverage for cars, for example, an insurer can be part of an ecosystem that offers roadside assistance, devices and apps that monitor and reward safe driving habits, and maintenance notifications and discounts for repairs. About 80% of insurance customers around the world are open to the idea of ecosystem services, and many of them are open to having insurers provide those services.”

White Paper

Boosting Engagement and Capitalizing on Rewards

How to Make Insurance Telematics and UBI Fully Work.

Better engagement underlies increased adoption of usage-based insurance (UBI) and motivates customers to adjust driving behavior to achieve desired program outcomes.

¹ Telematics boost customer retention. Swiss Re Group. https://www.swissre.com/reinsurance/property-andcasualty/solutions/automotive-solutions/telematics-boosts-customer-retention.html

² The Loyalty Report. Bond. 2019. https://cdn2.hubspot.net/hubfs/352767/TLR%202019/Bond_US%20TLR19%20Exec%20Summary%20Launch%20Edition.pdf

³ Effective Driver Coaching Partnered with Telematics Improves Auto Claims and Customer Loyalty. Aite Group. February 2020. https://www.adeptdriver.com/assets/resources/Effective-Driver-Coaching-Partnered-With-Telematics-02-21-2020.pdf