Policy Management – Guidewire

Seamless, out-of-the-box integration of telematics with Policy Management Systems allows insurers to enroll clients and manage their policyholder data through a single system – their Policy Management System. What does this mean? Insurers can save on integration costs, reduce the telematics program implementation times and decrease standard training time, with fewer systems to be trained on.

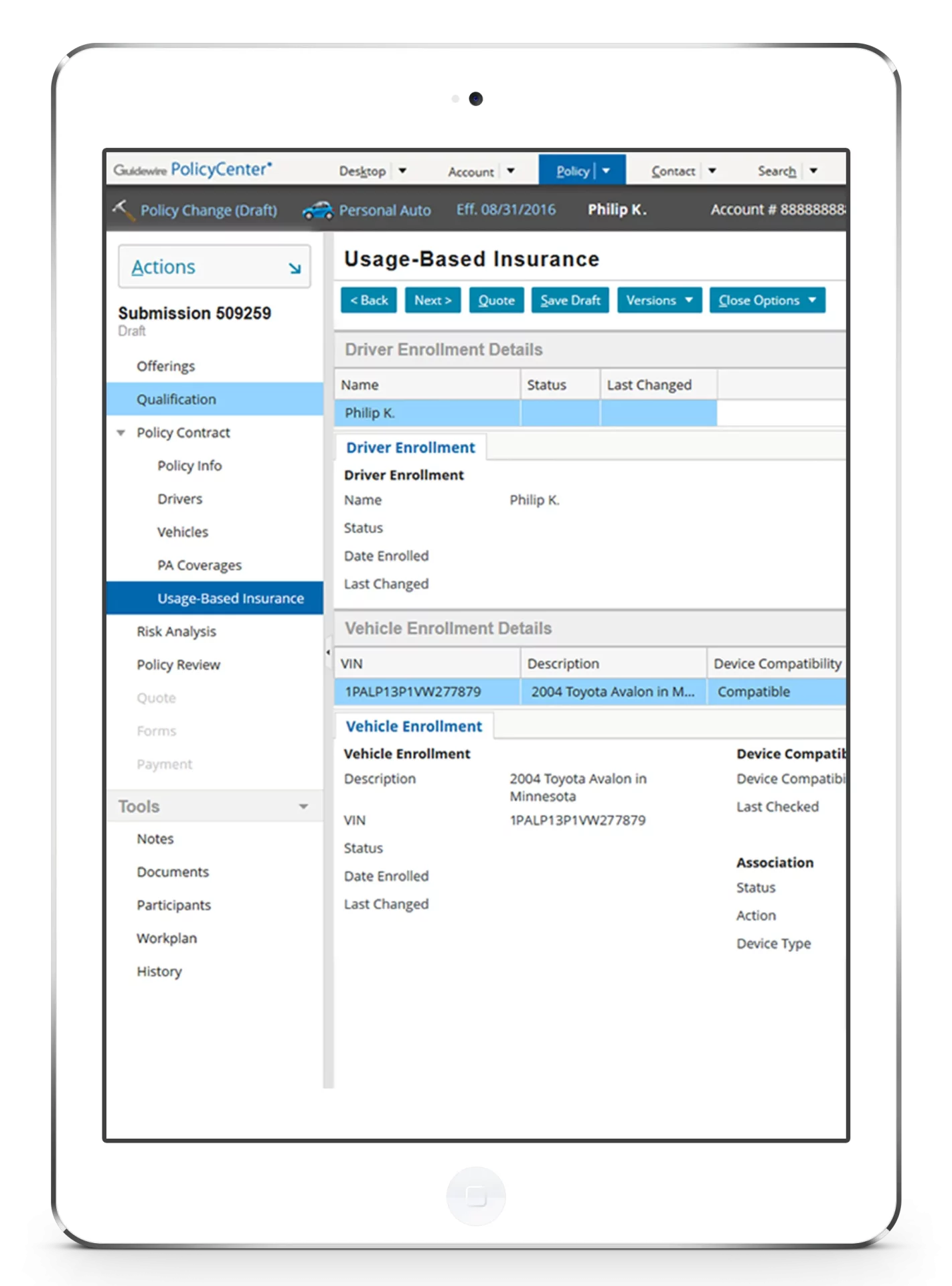

Guidewire PolicyCenter™

By partnering with Guidewire, IMS has delivered on a number of connected car and insurance telematics industry firsts:

- IMS is the first connected car and insurance telematics solution provider to integrate telematics with Guidewire PolicyCenter.

- IMS is the first to integrate Usage-Based Insurance into a Guidewire product offering.

- IMS is the first connected car and insurance telematics solution provider to announce availability of Ready for Guidewire accelerator – IMS’ UBI Enrollment

- Accelerator for Guidewire PolicyCenter.

- For more information about the IMS Usage Based Insurance Enrollment accelerator/add-on, visit:

Complete integration via IMS’ accelerator ensures auto insurers can manage their policyholder detail through PolicyCenter while, at the same time, ensuring the captured data is communicated back to IMS’ DriveSync connected car platform for analysis.

What’s Provided:

- IMS UBI Enrollment Accelerator for Guidewire PolicyCenter – Download from Guidewire’s Resource Portal.

Benefits:

- Save on integration costs.

- Reduce UBI implementation time for a faster path to market.

- Decrease sta training times – fewer systems to be trained on.

- Access to IMS’ go-to-market knowledge, expertise and experience.

Compatibility:

- Works with Guidewire version 8, 9 and 10.

Policy Management - Guidewire

Immediate Follow Up