Mobile Insurance Telematics

Mobile telematics is one of the many diverse technology options for data collection supported by IMS’ analyst-acclaimed and award-winning DriveSync® connected car platform. In contrast to vendors only offering single-point technology solutions for data collection, IMS’ platform approach offers insurers multiple options for in-vehicle data collection to help them segment and target their book of business with technology options best suited for specific participants.

Mobile insurance telematics and driver behavioral analytics presents a unique opportunity to transform the insurance telematics and usage-based insurance market by leveraging smartphone technology already broadly adopted by consumers, to cost-effectively collect driving behavior data, lower loss ratios and accelerate customer growth with an interface and user experience that engage consumers more frequently improving your customer retention.

IMS Mobile Insurance Telematics – Features and Benefits

For insurers, IMS Mobile Insurance Telematics makes collecting driving data quick, easy and cost efficient. In turn, policyholders are provided with a variety of in-app services that make for frequent use of in-app functionality with a host of intelligent features, making usage easy and increasing overall user engagement.

Safety Scoring Options

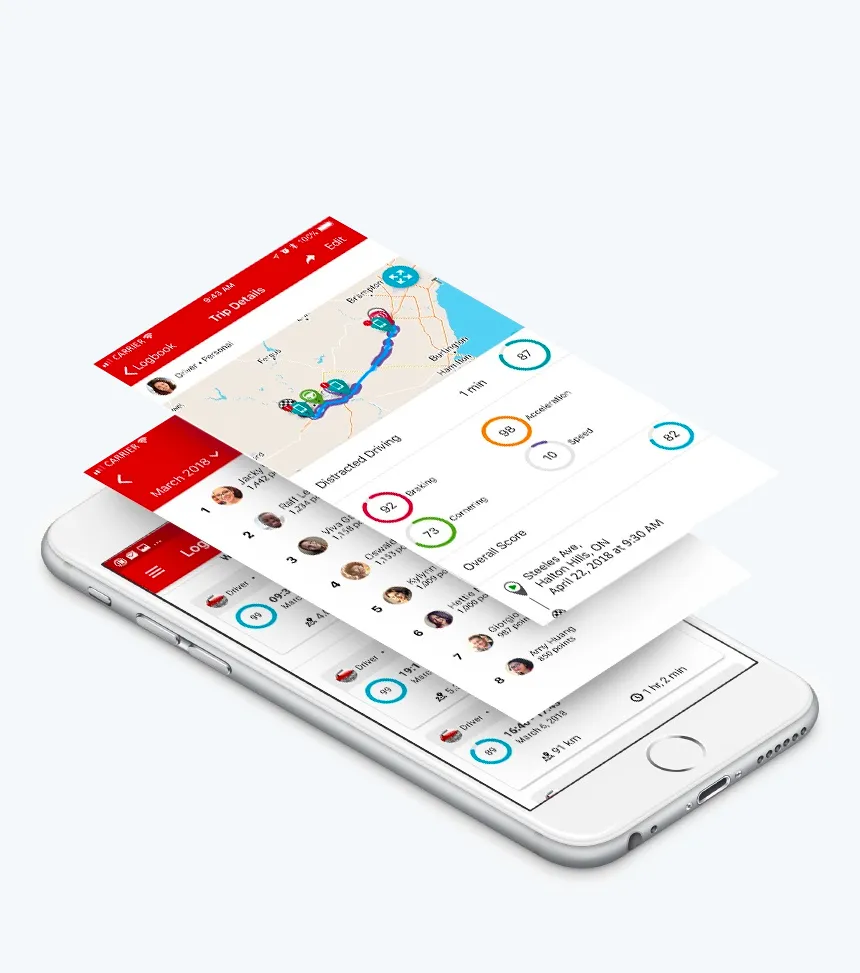

Enables insurers to create customized scoring while keeping the policyholder’s safety front and center. Available scoring variables include: Acceleration, Braking and Pay as You Drive (Time of Day, Day of Week and Distance). Scoring variables enable insurers to determine driver behavior risk, while policyholders receive coaching and feedback that help improve driver behavior; thereby, helping to reduce overall accidents and claims. Safety scores are also used to assess driver risk and provide drivers with discounts as rewards in usage-based insurance programs. Drivers also have the option to view their Safety Score Trend and Statistics to get insights on how they are improving over time.

Leaderboards

Enables drivers to view their driving score against other drivers and compete to be the safest driver. Drivers can choose to compete with all drivers in the same digital insurance program, or can create private leaderboards to offer personalized challenges and friendly competition to friends and family. Many insurers tie leaderboard activity to IMS rewards programs, such as prizes, contests and sweepstakes.

Reward Badges

Generate driving challenges with associated reward badges to incent safe driving behavior. For example, incentivize safer winter driving with a seasonal challenge that focuses on speed limits and braking to earn a limited-time reward.

Mobile Telematics Solutions - Request More Information

Contact Us for More Information