What the data tells us

Car clubs, commercial fleets (vans and light commercial) and daily car rental companies have had varying fortunes during the lockdown period. Analysis of telematics data from a sample of 22 UK-wide businesses provided by IMS between March and May 2020 has found:

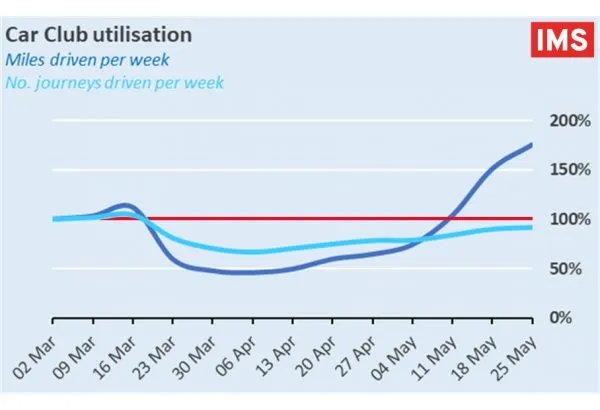

- Car club use dropped in the initial phase of the lockdown, but has bounced back since early-May, with mileage now exceeding pre-Covid19 levels at around 175%.

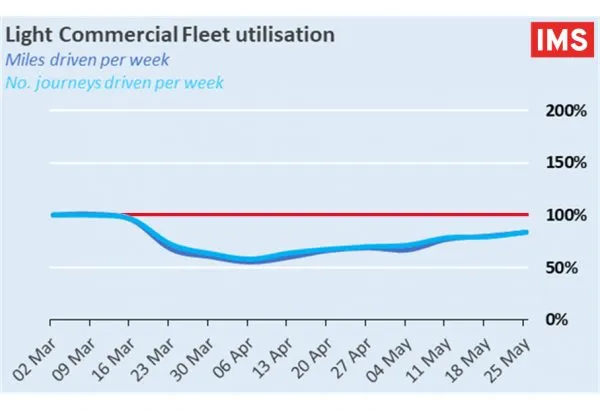

- Utilisation of light commercial hire fleets dropped noticeably in the early phase of lockdown, but by the end of May recovery was well underway. Most fleets are now operating at pre-lockdown levels.

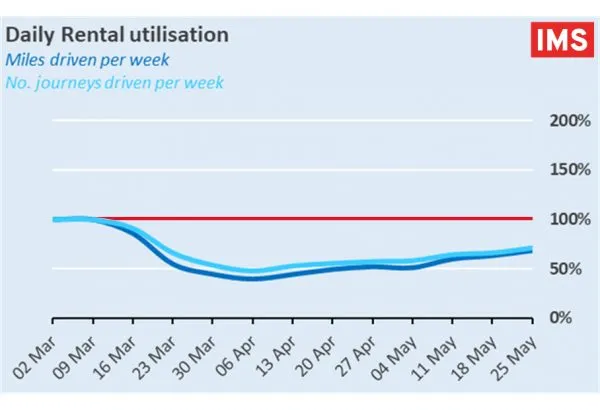

- Daily rental companies have been hardest hit, on average dropping to below 40%, and in some individual cases 20%, but now showing gradual week-on-week improvement.

Overall, the top destinations for car club drivers, who are almost all London-based, were DIY stores and retail parks (shopping), golf clubs (sports), parks and marinas (recreation) – all those Londoners needing to get to their yachts! There was no compelling evidence that Londoners were using car club vehicles to return to work.

Overall mileage across all three mobility fleet types dropped to 40% of normal levels in March and April, but since April there has been a gradual increase in weekly mileage, and by the beginning of June overall mileage was at 75% of pre-lockdown levels and continuing to recover.

Car clubs the big winners

Our data shows that car clubs are emerging as the big winners from lockdown. They have also seen a significant increase in subscriber numbers, so much so, that Covid19 may have saved their businesses.

In the two years before Covid19 hit, many car clubs had been struggling to deliver the growth they had promised their investors. Now, they are experiencing a surge in demand. With more Londoners returning to work, yet reluctant to use public transport, will the number of new subscribers continue to rise? I think it will.

Commercial fleets

Commercial vehicle hire fleets have been cushioned by the surge in home delivery as home shopping exploded during lockdown. From March to April journeys per week dropped to around 60%; they were back up to over 85% of the norm by the end of May. We understand that over half of all delivery fleets were classified by the government as essential service providers.

Rental companies

Car rental firms were hit by the collapse in business and leisure travel that began in March (many rental operations are linked to travel termini like airports and rail stations). Mileage per week fell to below 40% at the start of April. Journeys per week fell 50%. They are now seeing signs of a slow recovery, and they have adjusted their operations to meet short-term demand while they assess the prospects for 2021.

Looking ahead

We predict that the pandemic will be a breakthrough moment for car sharing, car clubs and ‘new’ mobility. Home working means employees won’t be commuting to work every day, and they may only need a car once a week. Car clubs fit the new zeitgeist.

The new normal for mobility poses challenges and opportunities for a number of adjacent sectors.

Motor insurance has come under much public scrutiny, not least because millions of customers have complained that they are paying full insurance premiums (often on monthly instalments) while their cars were going nowhere, during the lockdown.

Vehicle manufacturers now have the chance to leverage their own connected car data to offer customers highly-customised/personalised insurance that fits the customer’s intended use. Pay as you go insurance, multi-use policies, or miles-based programmes will suit reduced and or changing vehicle use post-Covid-19.

Let’s explore this in my next post >

If you would like to discuss further, feel free to reach out directly to myself using our Contact form: https://ims.tech/contact/