Although there is considerable value in gaining first notice of loss (FNOL) information at the time of an accident, many other possibilities are gaining attention by insurers as the entire claim handling process is enhanced through digital transformation.

FNOL is currently a leading insurer interest in claims data and management, but other claims factors, as seen in Figure 1 and listed below, are gaining prominence as adoption of telematics-driven capabilities becomes increasingly widespread and mass market across the insurance industry.

Figure 1: Extracting value throughout the entire claims process

- Fast Settlement – Closing claims swiftly can be accelerated by the accident data collected by telematics and the mobile-phone images taken at the scene. This typically results in reducing the average time to settle low-severity crashes.

- Liability Prediction – Crash data, if detailed enough, can be a valuable means to reconstruct an accident. This permits prompt, thorough prediction of liability. Surveys have demonstrated a slight shift of an at fault determination to not at fault when applying crash data results. In rental fleet, a more significant change in determination is evident for both at fault and not at fault incidents.

- Fraud check – Telematics data can help determine when claims are fraudulent by examining the facts of the incident.

- Injury assessment – Crash data indicates the severity of a crash and the direction of the impact. This sensor data, when compared against a comprehensive database of types of injuries at different levels of impact, can help reduce claims for certain minor injuries when not supported by data.

- Repair cost control – Being able to accurately assess the level caused by a crash offers better control over the cost of repairs. In turn, this enables selection of repair center and monitoring of repair costs.

- Litigation support – Legal costs can be steep for insurers, but telematics data that objectively tells the story of a vehicle crash can significantly reduce legal costs.

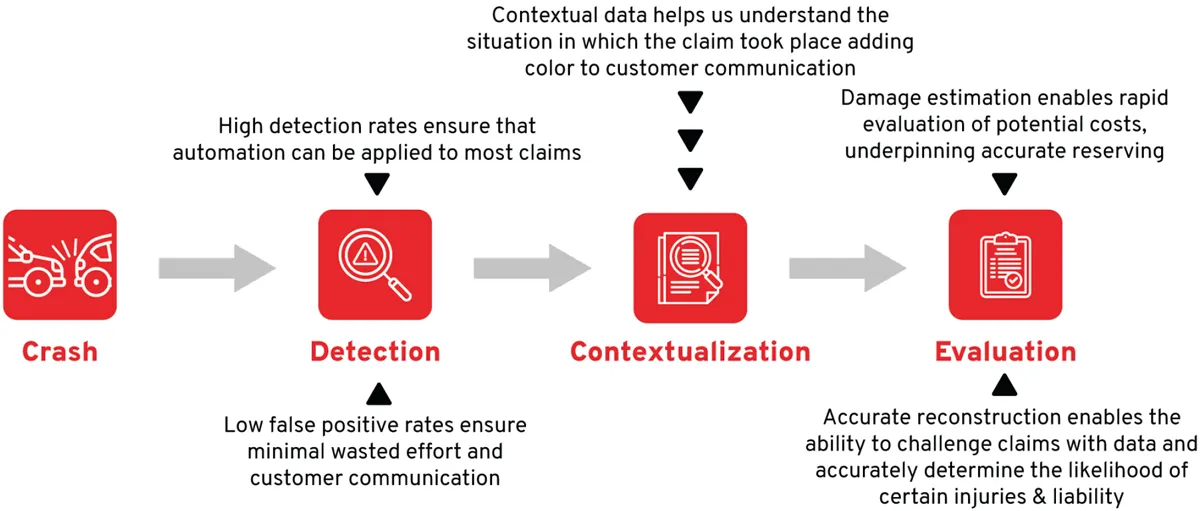

As shown in Figure 2, from the moment of the crash, accurate data from the scene helps paint a clear picture of the incident. Maintaining low false positives both minimizes wasted efforts and enhances communication with the customer.

As claims processing proceeds, having abundant contextual data available clarifies many factors associated with the crash. Being able to gain information quickly about the crash helps in establishing damage estimation, choosing a repair facility, summoning vehicle removal services, and determining the level of liability based on the types of injuries and knowing the magnitude of the crash.

Figure 2: Accurate data improves the claims process in several ways.

About IMS

IMS (Insurance & Mobility Solutions) is a vehicle and driving data business, delivering enterprise solutions to global insurers, mobility operators and governments. The IMS DriveSync platform provides the capability for customers to improve their approach to pricing, customer engagement, risk management and claims handling by leveraging telematics data from any source – smartphone apps, aftermarket hardware and OEM embedded units. The company, with offices across the UK, Europe and North America, has analyzed over 15 billion driving miles and its algorithms are fed by trillions of data points each day. For more info visit ims.tech

IMS Connected Claims

IMS Connected Claims is a low-cost suite of telemetry-based services that transforms collected telematics data into appropriate analysis that positively impacts the policyholder experience and an organization’s claims costs. The solution includes hardware, ongoing training and implementation consulting, along with expert support services.

Find out more: https://ims.tech/claims/