How insurers can help reduce carbon emissions with UBI & telematics

In an era in which reducing CO2 in the atmosphere has become vital to future generations, finding effective methods for cutting emissions of this greenhouse gas are essential. Globally, passenger vehicles generate 45% of the CO2 emissions, which rises to 75% including trucks. There is a simple way, however, to lower this impact: by using telematics as a tool to encourage a usage-based driving style that avoids the three prime causes of excess carbon emissions from vehicles: high speeds, strong acceleration, and hard braking.

1. High driving speeds and high carbon emissions go together

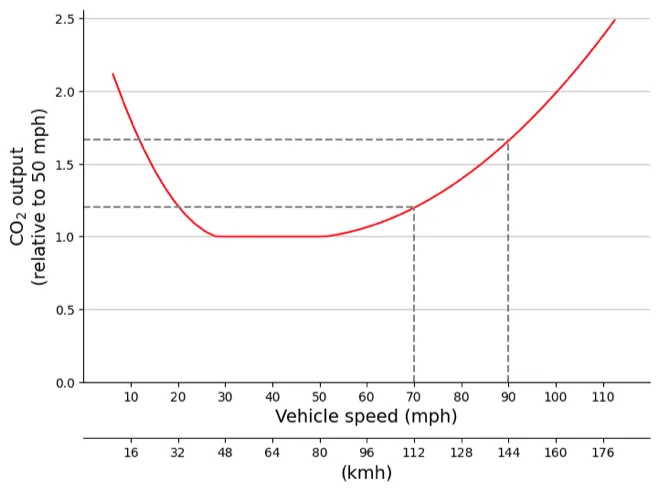

Both low and high speeds on the road result in carbon emissions however, driving at top speeds, and those over the speed limit, results in a more dramatic increase (reproduced from Speed Limit Induced CO2 Reduction on Motorways: Enhancing Discussion Transparency through Data Enrichment of Road Networks). For example, traveling at 90mph produces approximately 40% more CO2 than traveling the same distance at 70mph.

2. Going heavy on the pedal isn’t green driving

The Environmental Protection Agency (EPA) estimates that aggressive driving, which includes rapid acceleration, can lower your gas mileage by 15% to 30% at highway speeds and 10% to 40% in stop-and-go traffic. Lowering gas mileage, of course, increases carbon emissions in turn (since you must burn more fuel to go the same distance). A rigorous analysis of the effect of rapid acceleration on CO2 generation is detailed in Benchmarking the driver acceleration impact on vehicle energy consumption and CO2 emissions, which includes real-world driving styles and their impacts.

3. Harsh braking isn’t good for the environment either

Another part of what the EPA categorizes as aggressive driving is harsh braking, which often is part of a pattern that is marked by frequency acceleration followed by harsh braking. Harsh braking is usually a result of sudden traffic or congestion – commonly referred to as “stop and go traffic”. Hard braking is almost always combined with speeding and rapid acceleration, as such, these driving habits can result in an 5% increase in vehicle emissions, as documented in the same previously mentioned article.

Insurers can promote telematics & UBI to encourage safe driving behavior while also helping to save the environment

Telematics has many benefits for drivers and insurers, but one of the main benefits for insurers is the capability of coaching policyholders to improve their driving behavior to reduces accidents and claims – which in turn, reduces the three bad driving habits contributing carbon emissions.

By setting up a score that discourages unsafe behaviors that includes strong acceleration, harsh braking, and excess speed, insurers can point out when drivers are venturing into unsafe territory, as well as increasing their environmental impact. Many drivers will recognize the positive aspects and do what they can do to reduce the amount of CO2 generated. Insurers can set up various rewards and coaching programs to encourage better and greener driving behavior. Even if a driver is not solely motivated by greener, safer considerations, they are likely to respond positively to premium reductions or rewards that make the driving experience more pleasant.

Possible motivators include:

- Calculating CO2 savings and presenting values graphically to policyholders – Provide push messaging and engagement to policyholders that provides a graphical representation of carbon emissions to give drivers a clear view of what their impact is based on driving style and what values to strive for.

- Developing a rewards program to tackle the three worst CO2 emission driving habits – Through a mobile telematics app, offer special rewards to drivers who successfully keep to speed limits and minimize heavy acceleration and braking.

- Easy access to scores so drivers can see how they are doing – Based on our own experience running a direct-to-consumer digital insurer for more than a decade, introducing a program that offers weekly rewards for drivers who check their scores regularly has proven uptake and results. It was found that 56% of customers check scores daily and 88% check weekly when a rewards program is at play.

With understanding of the problem and positive reinforcement of good driving behavior, drivers have a solid motivation to change behavior and insurers provide a strong corporate social responsibility message to the public and their investors.

Bottom Line

Sadly, not everyone feels compelled to make a difference in their habits, even a simple difference such as driving more conscientiously and limiting excesses when behind the wheel; Telematics and UBI offers a tangible way to see what impact an individual’s driving has on carbon generation and given this knowledge, many people will opt for an enhanced driving style and contribute positively. Insurers can do their share to inform drivers of the potential impact, as well as reward them for minimizing the CO2 they generate.

The latest in connected insurance and telematics technology has the capability of detecting bad driving habits and, by alerting drivers and encouraging them to adopt more mindful driving styles, it can help reduce carbon emissions.