Three Pillars for Successfully Monetizing Connected Car Data

Given the market challenges so far in terms of establishing successful revenue streams to offset the expenses of providing connected car technology and services, OEMs are now creating new and innovative business models that will work—for customers, partners, and the OEMs themselves. Market Reports Center’s research estimates that Big Data investments in the automotive industry will account for more than $5 Billion by the end of 2021 and through the use of big data technologies, automotive OEMs and other stakeholders are beginning to exploit vehicle-generated data assets in a number of innovative ways ranging from predictive vehicle maintenance and UBI (Usage-Based Insurance) to real-time mapping, personalized concierge, autonomous driving and beyond.

McKinsey even analyzed consumer perspectives on the prospect of accessing car-generated data and has identified the overall revenue opportunity for industry players from car data monetization at a global scale might add up to over 750 billion by 2030.

Trends in the automotive industry point toward a data platform and always-on data capture and distribution over the lifespan of a vehicle. Tesla has successfully integrated this approach into their brand, strengthening their tie to customers by focusing on personalized experiences. Over the years, the company accumulates a wealth of data about each vehicle’s operational history—from both a vehicle and driver behavior perspective.

The value of the services and intelligence that can be derived from this data is the key. Data plus analytics yields intelligence and that intelligence has tremendous value across many markets. The considerable challenges of profiting from OEM data and connected car subscription services have troubled the auto industry since these services were first introduced. OEMs, however, can monetize the in-car data collected in a variety of innovative ways—as long as they manage certain essential considerations well. The value of deep insights about the drivers of their vehicles is a bonus beyond the basic monetization of the vehicle telematics data.

The connected car data monetization challenges faced by automakers typically involve three major pillars, all of which must be resolved as a part of an effective business model for providing connected car services.

PILLAR 1: DATA MANAGEMENT: INTEGRITY, SECURITY, AND PRIVACY

Building a business model that involves the capture, validation, provisioning, and distribution of massive volumes of vehicle data and driver behavior information requires considerable expertise and supporting infrastructure. Under the umbrella of data management, several specific areas of data handling must be addressed to meet the concerns of OEMs.

Transparency

Every byte of data about a vehicle and the driver operating that vehicle must be subject to full transparency and consent. The driver must be consistently informed of what automotive data is being collected, how it will be used, how long it will be stored, who else will have access to it, and what prerogative does the driver or vehicle owner have for terminating consent given for the use of this data. The most effective Big Data applications associated with automotive use assume an always-on model that can capture vehicle data throughout its cradle-to-grave lifecycle, whether it is in motion or parked, and includes a very wide range of parameters. The vehicle operator must give consent for the collection and use of every one of these parameters—from vehicle location to data capture of driver operations (speed, braking, the G-force of turns, and so on) to identifying the person behind the wheel at any given moment.

Privacy

Different jurisdictions around the world have varying levels of regulations and mandates in terms of an individual’s data privacy. These laws and mandates can be complex and in some case overlap depending on the region and even the state. Data privacy is important both for legal and regulatory measures with which the OEM and any partners must comply, in addition to the basic business principle of respecting and protecting all information that relates to their customers.

Failure to pay attention to data privacy could subject the OEM to fines or loss of their stature in the industry, as well as casting a dark shadow over the way that they are perceived by customers. When working through a service or intermediary that is handling data on behalf of an OEM, the OEM must ensure that strong data privacy protections are included in any agreement and followed consistently.

Security

Ensuring secure data exchanges is integral to any data monetization effort. Part of this involves monitoring and tracking where data is being sent, where it originates, and whether encryption is used consistently to secure data while in transit. Any areas in the data path that potentially allow intrusions or are vectors for abuse should be remediated to mitigate the risk. Risk has many different dimensions and security should always be implemented anywhere that a risk potential is identified. With rigorous, secure data protection mechanisms in place, hacking becomes a non-issue, rather than a concern for OEMs.

Required Vehicle Equipment

Many different mechanisms exist for capturing and transmitting vehicle and driver data. The hardware and software supporting this effort should be factored into the plan for monetizing car data. The range of hardware and vehicle types supported introduces a layer of complexity. Of critical importance to any monetization, program is the capability of collecting, cleansing, normalizing, and unifying collected data so that irrespective of the OEM’s hardware decision, the vehicle and driving information is delivered to each beneficiary in a uniform, usable format. Monetization demands that the management of data across this spectrum of devices in a consistent, verifiable manner. To maximize the data value, this management should include the earliest devices in the market, all those operating today, and new devices as they are introduced (always maintaining backward compatibility).

PILLAR 2: SUFFICIENCY OF THE DATA

For Big Data applications in the automotive sector to be successful, certain criteria must be met. Simply collecting and aggregating huge amounts of vehicle telematics data, without being sufficiently selective or qualifying the nature of the data, is unlikely to lead to the kinds of useful insights that will identify patterns, reveal trends, and derive statistically significant results.

Going into a project involving automotive data, key questions should be resolved at the earliest stages of planning such as:

- Considering the full range of data being captured, what data points are most relevant?

- How much data is needed to drive the analytics and provide value?

- Over what time period should data be collected to ensure that the analytic results can be trusted with a high degree of confidence?

Partnering with an organization experienced at the collection and processing of vehicle and driving data can answer these questions and provide assurance that you will get results from the data consistent with the project objectives.

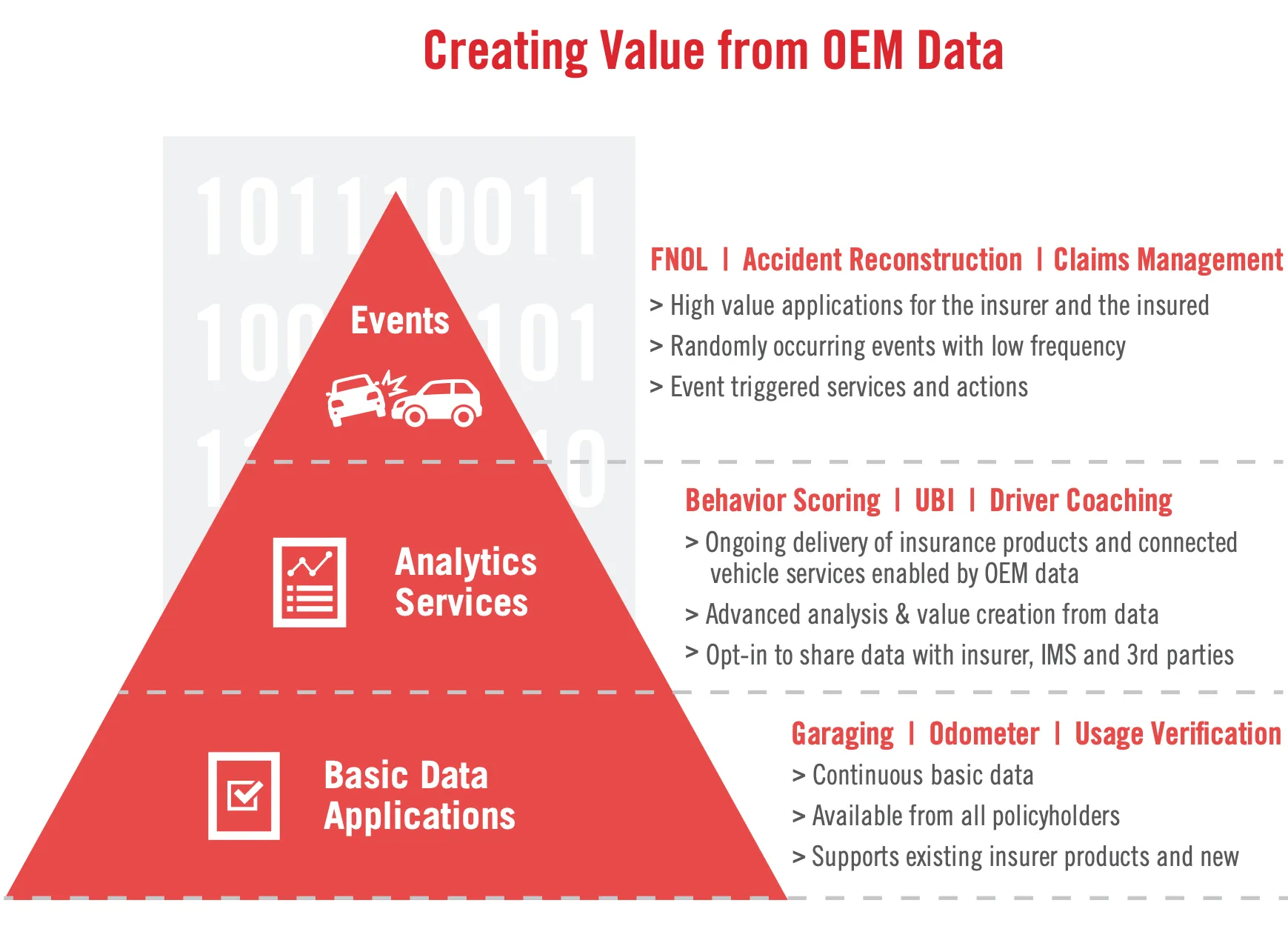

PILLAR 3: USES OF THE DATA

At the point where the mechanisms are in place to capture the data, permissions have been granted for acceptable uses, the question arises: what can you do with this data? This is the area where innovation, imagination, and cross-industry cooperation converge—the point where new opportunities emerge and fresh services can be developed. At this stage, the value of the data depends on the kind of usage and the area of interest. For example, city and state government organizations have an abiding interest in traffic control and safe vehicle road use. Emerging applications that track a vehicle’s movements over specific roads or turnpikes can institute fair-use road charges to drivers traveling these roadways—based on actual data. Other mobility data from vehicle locations can help reduce traffic congestion by intelligently manipulating traffic signals and automating passage through tollbooths.

Clearly, insurance companies are very interested in connected car data revealing driver behavior patterns, vehicle safety features, vehicle maintenance, and driver lifestyle. This data has considerable value to them and arranging a vehicle data exchange will benefit the OEM, the insured party, and the insurer.

The OEM ecosystem also benefits from this connected car data. Automotive service facilities with access to diagnostic and status data associated with a vehicle can use predictive analysis, incident logs, and historical data from similar vehicles to communicate with drivers about issues that require quick intervention or near-term attention. Other applications include understanding the driver’s habits, preferences, and lifestyle to better match the vehicle’s features, maintenance, and service programs to the owner’s requirements.

Emerging IoT Applications

Beyond uses envisioned for government organizations, vehicle service centers, and insurance companies, numerous opportunities exist—many still in the infancy stages of planning—for data that indicates consumer preferences, lifestyle matters, and daily routines. These opportunities often require a convergence of information from different sources, as is typical of emerging Internet of Things (IoT) applications.

The more connected car related data points from various sources that can be pulled into the analytics, the more intelligence can be derived from the data. Automakers can capitalize on providing highly personalized services to prospective car owners. Some of these kinds of capabilities have already been introduced in the industry, generally as piecemeal programs. The full potential, however, will only be realized once a dynamic ecosystem is brought into the process to serve as a data exchange and conduit for different information sources.

Access Connected Car Data Across Any Major OEM Brands Through Our Connected Car Data Platform

Explore the IMS Vehicle Data Exchange that provides mobility providers, insurance carriers and government customers with live access to full vehicle data and insight. The Vehicle Data Exchange uses a completely data-source agnostic approach supporting OEM embedded hardware and all aftermarket data sources.

Most importantly, only IMS can work with both OEM embedded hardware and all types of aftermarket data sources, with the ability to also supply all aftermarket data collection options.

Discover IMS Vehicle Data Exchange: https://ims.tech/vdx/