IMS provides a complete device monitoring options and telematics software suite for insurance programs and fleet vehicles. Our innovative and unique model for deploying and managing connected car insurance services increases customer profitability and maximizes a customer’s lifetime value, allowing both insurers and policyholders to gain complete visibility of drivers, vehicles and boost driver productivity and safety.

Table of Contents:

1. Overview of Telematics Device Options

3. Exploring the Advantages and Disadvantages of OBD-II Based Telematics Systems

1. Overview of Telematics Device Options

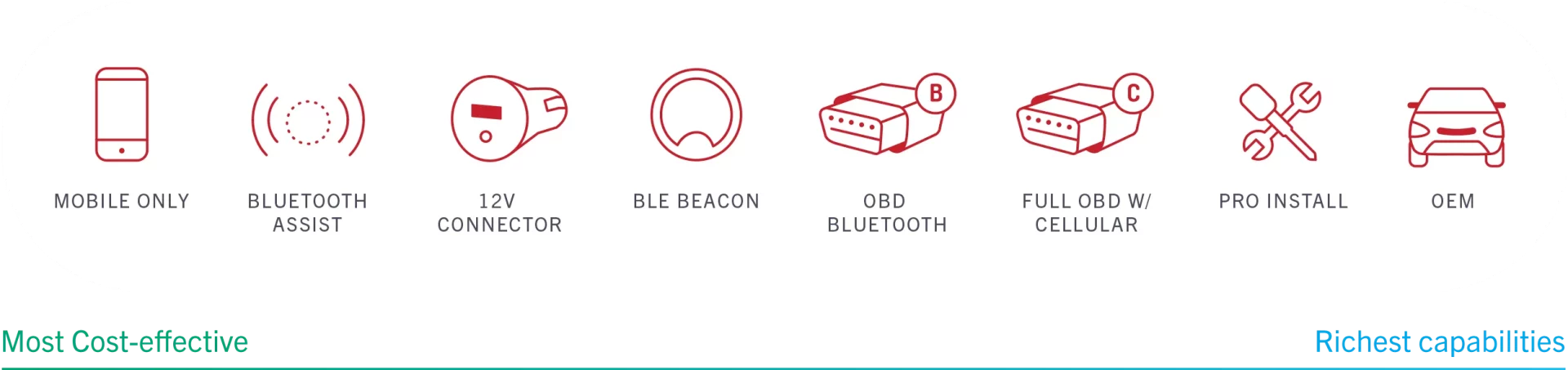

Our cloud-based DriveSync® connected car platform has received industry acclaim for its ability to offer customers a data source-agnostic, multi-device strategy for service provision versus a single focused technology approach.

2. Features + Add-ons

Reach more of your potential and existing customers effectively across multiple channels and devices without any challenges.

WHAT’S INCLUDED

ADD-ONS

Gain enhanced capabilities by extending the functionality of IMS Insurance Telematics with relevant add-on services.

3. Exploring the Advantages and Disadvantages of OBD-II Based Telematics Systems

One of the most fascinating areas of growth is data collection employing a vehicle’s OBD-II port – otherwise known as the on-board diagnostics port. As many drivers are now aware, usage-based insurance (UBI) and insurance telematics are currently having a huge impact on the insurance industry. Vehicles equipped with telematics devices allow an insurance provider to have more precise information to rate driver’s premiums such as on-road activity (including braking and cornering speed or acceleration), the time of day when driving, and the amount of time spent behind the wheel.

The advantages of this system are very straightforward: it allows insurance providers to analyze driving patterns and develop a more accurate understanding of how their clients act when they hit the road. That also means insurance providers can encourage safe driving practices and reward customers with lower premiums for good driving behavior thorough understanding when and where their clients drive, helping them configure a more accurate premium for each of those clients.

What’s the best way to collect data using telematics systems? Is the best solution OBD-II, mobile, or a hybrid option blending elements of the other two?

The answer to that question depends specifically on the nature of the insurance program in question. Let’s focus on OBD-II (known as EOBD, or European On-Board Diagnostics in Europe). OBD stands for on-board diagnostics – in essence, it’s a way for the vehicle to communicate information to a driver. It’s the system a mechanic will connect to if they need to learn more about the status of a vehicle’s various subsystems. Most vehicles since the 1980s have used this type of system to allow automotive technicians and car owners a way to learn more about a vehicle’s overall health. In fact, since 1996 all vehicles sold in the United States have been required by federal law to include the OBD-II interface.

But the OBD-II system can also be used to learn more about a driver. It can tell you how fast a vehicle is traveling, track a vehicle’s engine revolutions per minute (RPMs), help calculate fuel consumption, and even track trip data.

Now, using advanced automotive telematics systems, it’s possible to use the OBD-II interface to show an insurance provider how their clients are acting out on the road. This system depends on the usage of a dedicated built-in monitoring and diagnostics system.

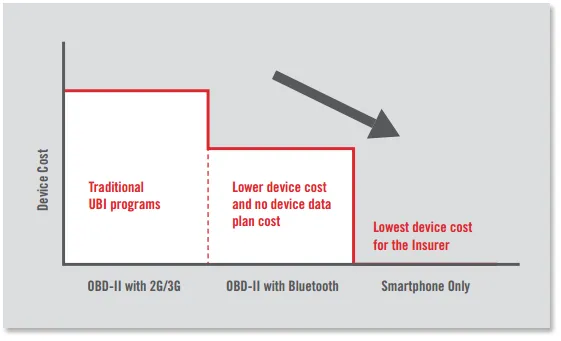

There are several ways to implement an OBD-II-based telematics solution. One option is to use 2G or 3G mobile telecommunications technology to send information. Another option is to employ OBD-II with Bluetooth which, because it doesn’t require a separate data plan, represents a lower cost alternative. This introduces a number of advantages and disadvantages to using an OBD-II solution.

THE ADVANTAGES

- For one, this is the longest-running and most prevalent telematics solution on the market – which means it’s got a proven track record.

- Telematics devices designed to be used with OBD-II systems are specifically targeted at that platform, meaning the data collected will be fair and unbiased across all demographics and vehicle types.

- Reliability. Because these devices are tailored to this platform, vehicle-to-insurance carrier connectivity is quick, accurate, and transparent.

- The OBD-II hardware solution is exceptionally secure. That sets it apart from a mobile-based system, which could, potentially, be compromised by some type of malicious software. That rather scary possibility is highly remote when it comes to an OBD-II system.

- The integration between internal vehicle information and OBD-II-based systems allows for value-added services, including maintenance reminders, roadside assistance, and crash notifications.

THE DISADVANTAGES

- Of course, the OBD-II method of collecting data also has its drawbacks, starting with its physical limitations. Most vehicles have only a single OBD-II port, meaning that other devices may compete with UBI telematics applications in this space.

- Second, the hardware costs are higher for OBD-II systems. Unlike a smartphone or mobile telematics solution, OBD-II-based systems require the production and distribution of a physical device. That can be expensive for insurance providers to maintain, driving down the potential profits reaped from such a program.

- Finally, there are vehicle compatibility concerns. In North America, only vehicles made after 1995 are guaranteed to have an OBD-II port. As we all know, there are many older vehicles on the road today and this limits the appeal of an OBD-II solution.

If your company is looking to enter the usage based insurance (UBI) market, but is concerned about extensive start-up costs or a lengthy program development phase, there are a range of UBI options to suit your economic and intelligence needs: from no hardware (Mobile Telematics), no start-up TaaS® (Telematics as a Service™) cost programs with basic data all the way to top tiered, value-added solutions that provide the highest possible grade of driver data and intelligence.

We recommend that anyone interested in exploring data collection solutions contact an experienced, knowledgeable telematics provider. They can help you carefully evaluate the advantages and disadvantages of prospective telematics solutions, including OBD-II, mobile, and the hybrid option.