Practical Claims Cost-Reduction Strategies to Help Insurers Remain Competitive As Technology Evolves

Like any other business, property and casualty (P&C) insurance companies must effectively manage internal costs to ensure sustainable profits and growth. For an insurance company, some of the costliest processes involve claims, which represent a major service function of any insurer but can become a major financial drain if not handled in a time- and cost-effective manner.

Should the combined ratio of policyholders increase and the cost of accurately processing claims become too onerous, an insurer will need to raise their premiums – never a popular option for insurers or their customers. So, how can insurance providers increase efficiency, lower their combined ratio and keep claims processing costs at manageable levels while ensuring they meet the time- and cost-sensitive needs of their customers?

Embracing Digital Claims Telematics Technology To Remain Competitive

The first step involves identifying the major cost categories. Once that’s out of the way, it’s important to put thought into how those costs can be more effectively managed and kept in check.

The good news is that there are emerging technologies – most notably, claims telematics and use of telemetry data – that have the potential to radically improve (indeed, possibly revolutionize) how insurance providers go about handling and processing claims.

At the same time, telematics can be used to more rapidly respond to customer claims, enabling an insurer to improve their relationships and experiences with clients. With telematics, a claim can be started right at the very moment a collision occurs, giving an insurer the tools and resources required to start processing a claim at the time of an accident.

Imagine, for a second, how a customer might respond upon learning that the collision they just experienced is already being handled and processed by their insurer including dispatching a towing service to their location and directing the delivery of the vehicle to the policyholders desired service center – thereby limiting how much time they can expect to wait before returning to normal use of their vehicle (should that be possible).

In fact, it’s possible that using these technologies to their full potential can allow an insurer to better balance their desire to drive greater profits with their need to maintain the satisfaction of their customers’ claims experience.

Currently, insurers are spending the bulk of their time and resources in the following claims areas:

- FNOL (First Notice of Loss): including early accident detection and alert service; instant control over recovery and remediation; and improved duty of policyholder care.

- Claims Liability: Including validation and analysis of data and compelling evidence to turn fault claims to non fault, 50/50 settlement to non fault and identify fault claims quickly to manage claimant costs.

- Claims Handling and Processing: including intervention; faster, more accurate liability decisions; and fraud detection.

1. FNOL (FIRST NOTICE OF LOSS)

Insurers know that the first step in the claims process is initiating a claim. The First Notice of Loss (FONL) is the initial report made to an insurance provider following a loss, theft, or damage of an insured asset. In the past, this has followed a well-known path: an accident occurs, and the customer reaches out to their insurance provider to relay pertinent information. This information includes when and where the accident occurred, who was involved, a police report (if provided), and relevant photographs.

This P&C claims process can be lengthy, taking days, weeks, even months in some cases. The way these timelines take shape depends on the actions of the customer, a condition that presents the insurer with many challenges.

The collection of all pertinent data can be complicated by a variety of factors, from whether the customer is injured or the subject of a criminal investigation. In any case, the longer the claims initiation process takes, the greater the chance that the insurer will incur excessive cost resolving the matter. Additionally, a longer process can create tensions between the insurer and the customer, opening the door to loss of business.

How Telematics Can help Initiate a Better, Faster and More Cost-effective Claim

Many of these challenges in the traditional FNOL claims initiation process can be avoided through the adoption of telematics incident detection technology and use of vehicle telemetry data. That’s because telematics accurately identifies likely collision incidents and allows for the wireless communication of important information about an event directly from the vehicle right to the insurance provider.

Vehicle telemetry data includes location, course and speed, impact severity, vehicle rotational movement, even second-by-second visualization through Google Maps and Street View. In essence, the use of telematics allows an insurer to gather a wide spectrum of relevant information that, from the time an accident occurs, allows them to start piecing together an accurate image of what, exactly, took place.

This is important for several reasons. First, it allows an insurer to begin the claims process much, much sooner than in the past. This increases the chances of completing the claims process in a relatively short window of time. Research shows this is what many consumers want from their insurance providers. According to J.D. Power, a majority of consumers said they’d happily share data with their insurer if that meant speeding up the claims process. Meanwhile, nearly half of consumers who spoke with J.D. Power said they’d leave an insurer that failed to provide digital offerings – like telematics support – for claims.¹

These aren’t the only research numbers worth paying attention to. A separate study from Ptolemus shows that insurance providers can, on average, save $800 (£612) on a claim if the FNOL is received within the first 30 minutes. Given the tight window, that’s typically only possible with telematics and the wireless transfer of telemetry data. At the same time, Ptolemus’ research shows that the average cost of a claims process jumps by a full one-third if the event is reported after a day has passed.²

Second, it allows the insurer to validate what the customer is telling them about the accident, thereby reducing the chances of insurance fraud. Together, these two factors can help an insurer save time and money.

In essence, customers want their claims handled as quickly and efficiently as possible, while insurance providers stand to save money on these claims the faster data are collected and processed.

2. CLAIMS LIABILITY

Although insurance providers have created a series of processes for validating claims to reduce claims leakage in the past – including sending agents to discuss claims with customers and investigating physical evidence, like a damaged vehicle – it would be safe to say they’ve had access to only a limited amount of relevant information. Generally speaking, insurance providers relied upon witness accounts, police reports, and any follow-up investigations to create a somewhat coherent picture of what occurred.

This limited range of data available to insurance providers has left a door wide open to fraudsters who effectively exploit gaps in the information to enrich themselves. The cost of this fraud is high – it forces insurers to regularly go to court and, far too often, make payouts when they may not be warranted.

Just how much does fraud cost insurers and their customers? By some estimates, it’s as high as $2.48bn (£1.9bn) a year in the UK and over $7bn (£5,35bn) in the Americas alone. These costs are particularly visible in “no fault” states or provinces, where every driver involved in an accident must report to their own insurance provider. Critics of this system say it’s more vulnerable to fraud.

Often, these costs are passed on to customers, the vast majority of whom are honest and loyal. These costs take the form of higher premiums and have the potential to hurt an insurance provider’s relationship with established, trusted customers.

How Telematics Can More Accurately Help Validate Claims

So, how do you validate claims more effectively, thereby closing the door on potential fraud?

Simple: you build a fuller and accurate picture of what took place by growing the pool of data available to insurance providers. And you do that using telemetry data that can provide clear evidence of what occurred, from when and where the accident took place to who was involved, how fast they were moving, and more. With this kind of information at their fingertips, insurance providers can create a clear picture of what occurred and get started on resolving a claim sooner. For an insurance provider’s honest customers, that’s a win-win.

Telematics plays a key role in identifying claimant injury, injury claims which are either fraudulent or inflated can use compelling telematics data evidence to challenge the claim at an early stage thus reducing processing and litigation costs with dramatic effect.

Additionally, and perhaps most importantly, telematics allows the insurer to determine liability and provides factual evidence to defend against fraud and inaccurate representation of court cases. This is an important consideration for any insurer evaluating who was responsible for a collision. Telematics technology and predictive analytics provide an insurer with a vast quantity of data and intelligence unavailable in the past, allowing them to more accurately determine liability.

Since accurately determining liability accounts for a considerable amount of an insurer’s total expenditure – in terms of both time and money – being able to more accurately determine liability has the potential to allow an insurance provider to determine risk and limit their liability outlay and significantly reduce liability costs today and in the future.

3. CLAIMS HANDLING AND PROCESSING

The claims handling process – or the process of actually completing a claim and distributing compensation to deserving parties – is affected by telematics in a few big ways: for one, it’s finished much sooner (please refer to the FNOL section above).

Secondly, and perhaps most importantly, it saves the insurer money through a smarter approach to cost reduction. That’s because an insurer can save on the many requirements that come with a prolonged claim processing experience. Should a claim take a long time to initiate, validate, and process, customers will require more support – from discussing matters with an insurer’s customer service team to being provided with towing and a rental vehicle.

How Telematics Can Help Build Stronger Relationships with Customers

With telematics, insurers can immediately begin assisting the policyholder and processing the claim, while directing the towing service to the policyholder’s desired service center reducing a need for prolonged and repeated conversations between a customer service team and a client. Additionally, if the claim is processed quickly, there may be limited (or even no) need for a rental vehicle. This can enable an insurer to save hundreds, possibly even thousands of dollars on each and every claim and that can add up, regardless of an insurance provider’s size and customer base and auto insurance premiums.

In the end, claims telematics can allow an insurance provider to cut some serious liability claim costs. A market study conducted few years ago revealed the average auto liability claim for bodily injury was around $16,640 (£12,729); the average collision claim was $3,160 (£2,417) and the average comprehensive claim was $1,567 (£1,198). New discoveries from the Insurance Research Council’s (IRC) Auto Injury Insurance Claims Study demonstrates that restorative costs detailed by injury claimants continue to increase faster than the rate of inflation, regardless of the way that the seriousness of the injuries themselves remain on a downward trend.

Conclusion

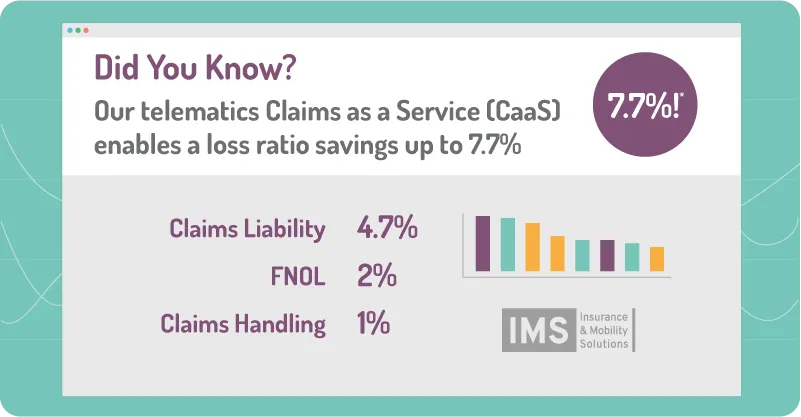

Clearly, the age of overly focusing on traditional FNOL, investigating and processing claims by parsing police reports and witness accounts as a means to reduce costs is ending. For insurers, having a strategic focus to all three sources of claims cost can decrease loss ratio by as much as 7.7% with such savings being passed down as premium discounts to further retain policyholders, as opposed to premium increases caused by claims.

Ultimately, creating a comprehensive picture of traffic events, optimizing the claims process and mitigating the risk of insurance fraud by leveraging predictive analytics, claims as a service (CaaS), incident detection for FNOL and telematics data governance is something worth looking forward to. The costliest decision an insurance provider will make could be deciding to delay the adoption of these helpful, forward-thinking telematics-based solutions.