Insurance companies are already using data to better inform the underwriting and claims processes. But the data derived from OEM devices is currently a missed opportunity and not yet widely used. That’s because, with automakers using their own standards and formats, putting it to profitable use has seemed far from straightforward – until now.

If you’re an insurer looking for a low-cost, low-risk way to monetize OEM car data, we’ve got some good news. There are three simple ways you can introduce this data to your business – each with a clear commercial application. Best of all, you can avoid the perceived problems of data standardization and privacy issues, giving you access to data you can put to use today. All you need to do is select the right telematics service provider (TSP) with the ability to handle data from both aftermarket and OEM sources.

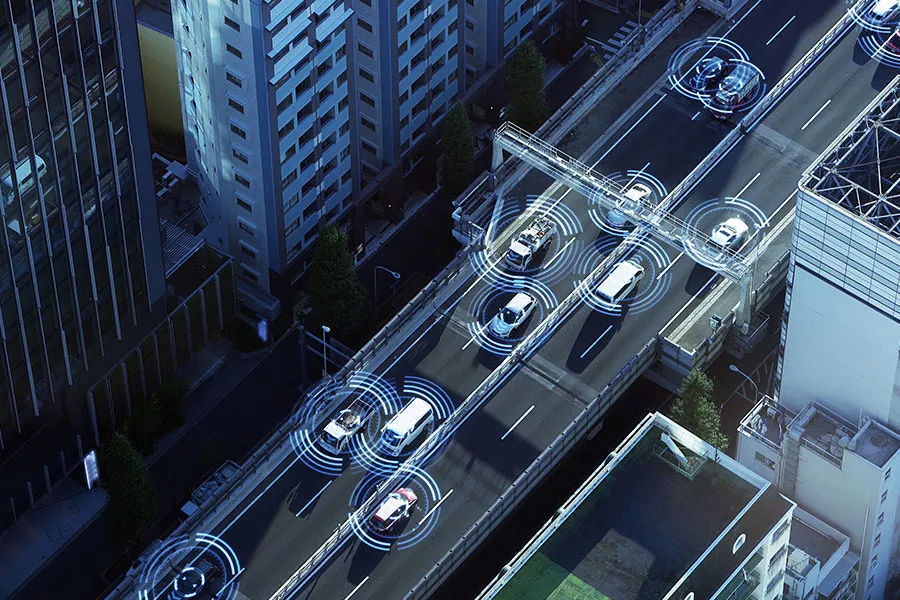

What Is OEM Vehicle Data (Also Known as Connected Car Data)?

Before we explain our top three connected car insurance use cases for OEM data, it’s worth explaining what we actually mean by the term, ‘OEM data’. Unlike data sourced from aftermarket devices, OEM car data is information that has been shared by a vehicle using embedded hardware and software that was built in at the time of manufacture. In this way, it differs from the telematics solutions used in the first wave of usage-based insurance models.

Many insurance companies have avoided OEM data due to the perceived technical complexity and costs of integrating it with the data and telematics programs they already have in place. But thanks to recent developments in the TSP sector, this is no longer the case.

The cost/benefit balance is changing

OEM vehicle data is not new. Insurance companies are well aware of its availability. In principle, its value to insurance companies is enormous, as in some use cases it does not incur the cost of fitting aftermarket hardware to vehicles. But there are still many cars on the road that are not ‘connected’. For this reason, data from aftermarket devices will be with us for the foreseeable future. Any application of OEM data must be able to make use of data from both sources. In other words, a hybrid approach is necessary.

It is easy to see why many insurance companies have avoided the issue until now. Within OEM data itself, there is a lack of standardization – the result of multiple, competing car makers implementing their own hardware and software according to their own design objectives. But not all data is created equal. Much of it can be aggregated and cleansed quickly and easily. In partnership with the right TSP, you can access a treasure trove of OEM vehicle information in a format that can be normalized against any aftermarket data you already collect – and all without compromising on regulatory compliance or the privacy of the drivers you insure.

This means that OEM data can be used alongside aftermarket data in numerous ways. In this article, we’ll look at three applications that could be of commercial value in your business – all of which can be implemented in conjunction with aftermarket data you may already use.

Three Connected Car Insurance Use Cases You Can Use Today

Broadly speaking, there are three key use cases for OEM data, based on the applications most consumers want to see. We refer to these use cases as Mileage & Simple Behavior, Vehicle Health Reports and Fault Codes.

Use Case 1: Mileage & Simple Behavior

Mileage is among the simplest data types vehicles produce. This data is available directly from the odometer in all connected cars. The most obvious application of this data is mileage verification when a customer applies for a policy – but it doesn’t stop there.

Because it can be collected in real time, it can be used to deliver insights into usage of the vehicle by time of day, as well as frequency and duration of journeys. Of course, if you know how far a car travelled, when it set off and when it completed its journey, you can calculate its average speed. Further analysis of the data can give an indication of how fast the car was driving at any particular stage – even how aggressively it accelerates. For insurers, this information can form the basis of usage-based pricing.

Best of all, this ‘simple data’ can be more complex, depending on your requirements. Most connected cars record data on braking, steering and acceleration in real time, giving you a much more accurate picture of how a policyholder is really driving. If the car is involved in an accident, this will be clear from the data – much as it would be if the car was fitted with a black box. It means you can create services based around responding to the accident and offering the driver proactive assistance in making a claim.

Use Case 2: The Vehicle Health Report

At the very heart of OEM data collection is the idea of remotely monitoring a vehicle’s state of repair. By monitoring this data in real time, you can gain a clear picture of each vehicle’s ‘health’ – from the pressure in individual tires, to the status of the various advanced driver assistance systems (ADAS) e.g. advanced cruise control, lane detection or autonomous parking. These faults can be monitored over time, which means you can see when a fault has been overlooked for some time and not fixed. In the case of a fault that is potentially dangerous (to the driver, other road users or both) a direct communication with the customer may be warranted.

Use Case 3: Fault Codes

Fault Codes can be seen as the logical next step after a Vehicle Health Report. To supplement the data from the report, the vehicle’s fault codes can be provided in real time, to help you determine the severity and diagnosis for any issues, as they arise. For insurers, this can help highlight serious problems that have not been resolved by the policyholder, or maintenance issues that have already resulted in claims. The data can be used to drive improvements in customer experience by notifying drivers of faults via your mobile app. For example, a fault could trigger an automatic notification, which is issued alongside a voucher for discounted repair work at an approved maintenance partner. If the customer undertakes the work as advised, they may in turn see their premiums reduced – or better yet, avoid an unsafe scenario that could lead to a collision, resulting in a costly claim. The result offers benefits for both parties – the customer has a better experience and feels more loyal to the brand, while at the same time, your costs are minimized, due to the reduced likelihood of a claim resulting from the fault.

Connected Car Data Is Just the Beginning

The above use cases show how easy it can be to derive valuable information from OEM vehicle data. But the more data you have, the more data you can combine, to reap ever more useful business insights. Take the first use case – Mileage & Simple Behavior. Because the data is collected over time, you can overlay other time-based data, such as weather conditions. If you can see that certain drivers were reluctant to slow down or otherwise change their behavior in icy conditions for example, it might tell you something about their risk levels that the basic report did not. The more data you bring to the table, the more knowledge you can bring to bear in your operational decisions – providing that data is cleansed and aggregated correctly.

A Hybrid Approach Is Here to Stay

Many of the cars in use today were built before the connected car revolution. Many that have been built since – including some of those being built today – are not equipped with embedded data sharing technology. The insurance industry therefore should support a hybrid model of data collection, normalization and analysis to deliver better customer experiences.

While standardization will almost certainly come to pass in time, the priority for insurers right now is undoubtedly to integrate and capitalize on connected car data as it continues to evolve, facing the challenges of real-world implementations, and gaining acceptance or rejection based on their merit.

Choosing the Right Telematics Partner

For most insurance companies embarking on this journey today, the best way to do this is to work in partnership with a TSP.

Your TSP must have the capability to handle data from all appropriate sources, including embedded hardware, smartphone applications and telematics hardware placed in-vehicle. They should have demonstrable experience in dealing with privacy and compliance issues in all territories in which you operate. And they should have commercial experience in the insurance sector – practical knowledge of the pitfalls of dealing with data in your industry.

By selecting the right partner, you can undertake product development projects that could otherwise prove prohibitively costly – and gain an advantage over your competitors by bringing new products to market faster.

About IMS

IMS is a vehicle and driving data business delivering connected solutions to global insurers, mobility operators and governments. Our People-Powered Technology™ enables innovative risk-based pricing, customer engagement, behavioral modification and claims management, supported by our unrivalled industry experience and proven customer success. With offices in the UK, Europe and North America, IMS captures and analyzes over 1 billion kilometers, 22 million driving hours and 80 million trips per month through our fully data-source agnostic IMS DriveSync® platform.

To learn how IMS can help your organization with real-time connected car data, visit https://ims.tech/vdx/.