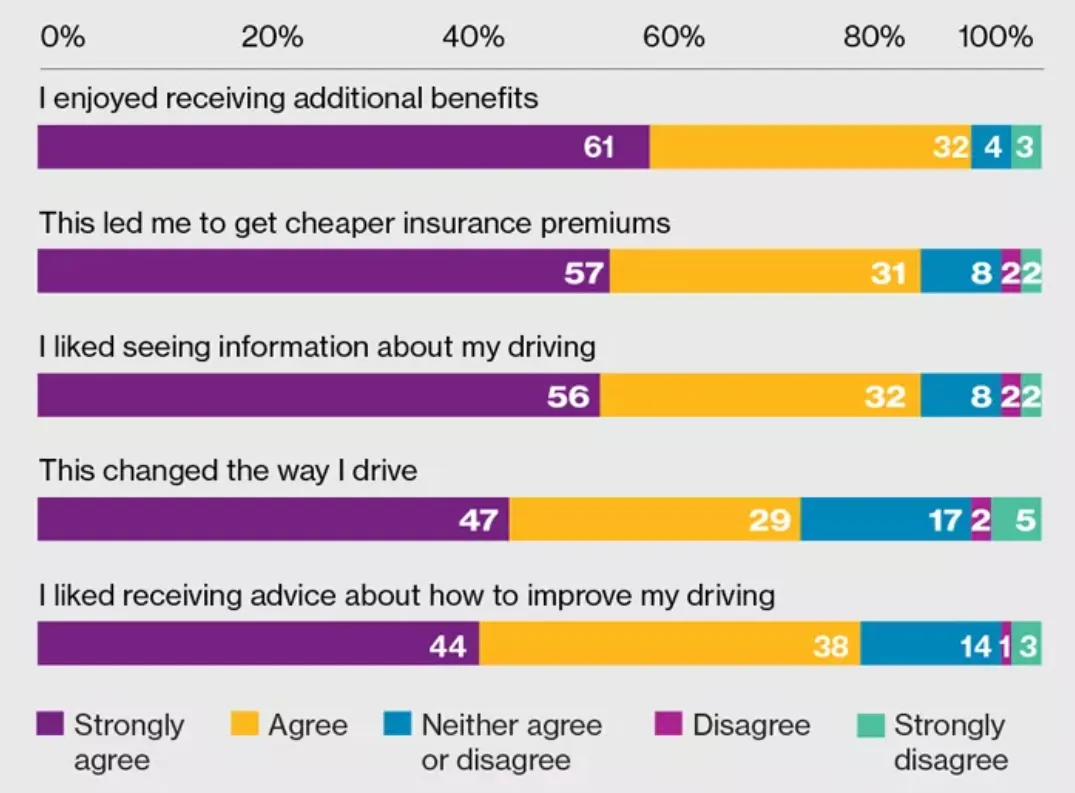

Insurance customer expectations are rising as innovative startups and forward-looking traditional companies are introducing unique personalized experiences, digital dashboards that integrate sales and service, and mobile solutions well adapted to modern automotive lifestyles. Telematics-based UBI has been a significant part of the digital transformation of the insurance sector and a leader in influencing the evolution of the industry. By offering consumers greater control over their driving data and delivering real-time communication giving advice on driving behavior (granting rewards for better performance or issuing timely communications when driving behavior significantly falters), engagement and loyalty rates are increased.

“Insurers need to find the ‘sweet spot’ where the offerings and the experience they deliver match consumers’ evolving expectations.”³

Accenture Research, This Time it is Personal

The Hidden Key to Engaging Policyholders

Global Market Insights (GMI) projected that the usage-based insurance market will experience a compound annual growth rate of 21.6 percent over the forecast period, 2019 – 2026, reaching over USD 115 billion in 2026.⁴ GMI attributes this growth rate to:

- Shifting focus towards remote diagnostic technology

- Growth in the number of connected cars bringing new UBI opportunities

- Rising penetration of smartphones integrated with vehicle connectivity systems

- Rapid use of UBI by insurance companies to improve profitability

For all the growth potential and abundant opportunities presented by telematics-based UBI programs, as well as the numerous programs already being offered by major insurers, the market has still not crossed the barrier to widespread adoption. Penetration of the market has been slower than anticipated and the reason appears to be the lack of focus on brand engagement. Discounts as an incentive are not enough to keep policyholders satisfied and other efforts that have been tried by insurers to drive engagement have consistently underperformed.

Frequency of engagement is one of the key elements that has been missing from many telematics programs. Forward-looking insurers are increasingly recognizing that frequent, high-value engagement—as often as daily—can be combined with other incentives to accelerate the adoption of telematics programs. The techniques for successful engagement—backed by statistical data provided later in this paper—can be the hidden key to unlocking the full range of opportunities provided by telematics programs and attracting drivers who respond to incentives with genuine value. Through responsive, regular communication with policyholders and the right mix of engagement modes, insurers can break down the barriers to wider adoption of telematics-based UBI programs and increase their market share.

Quoted in the Insurance Business Magazine, Justin Thouin, co-founder of CEO of LowestRates.ca, said, “The easier they [telematics programs] are to use, and the more user friendly they are, I think the better penetration telematics will generate. It’s something where there needs to be an education to consumers about what telematics is or isn’t, because the average policyholder doesn’t know it exists. And among those that do know it exists, they don’t know actually how easy it can be to save money.”

The Willis Tower Watson survey⁶ indicated that most drivers felt that it was very important or important to be able to monitor driving behavior, and rated these factors as significant: control over premiums, environmentally friendly driving behavior, and parental monitoring of young drivers as key factors, among the other considerations shown in Figure 1.

“As auto insurers continue to introduce new telematics systems, they risk losing opportunities to fully engage new customers by limiting the benefits and feedback. While carriers still have a way to go before fully integrating this technology into their value chain, they must start looking beyond discounts to fully engage customers and build relationships. Personalized advice programs that provide customers with pertinent data about how they drive and how to drive more safely can be paired with other options to help create a more complete solution that increases customer engagement and improves retention.”⁵

Insurance Canada

Data Use and Privacy Sensitivities

Disclosing driving information, however, is a sensitive point with many drivers that cite privacy issues and “Big Brother” oversight concerns as reasons for their reluctance. A Pew Research Center study examined the circumstances that are acceptable to Americans when they are sharing data. Their perspectives often considered the value of whatever they received in exchange for providing personal information. For example, almost half of Americans in the survey (47 percent) found free loyalty cards that saved them money on purchases as a reasonable value in exchange for monitoring their purchase history. For the customer, the value must be perceived as ample compensation for the information.

A J.D. Power survey highlighted how deeply these privacy concerns run. Most consumers were insistent that insurers be completely transparent about what data was being collected and how it was being used.⁷

More Than Rebates or Refunds Needed

Simply providing discounts to insurance customers doesn’t necessarily have the intended effects on retention, as discovered during the early 2020 worldwide lockdowns that greatly reduced vehicle use. As a J.D. Power study noted: “The study suggested that once customers become aware of the premium refunds being offered by their auto insurer, they are nearly 1.8x more likely to shop around for coverage. J.D. Powers said that one of the best ways to prevent customers from shopping around for different coverage is to engage them individually – but found that only 36% of customers had been contacted. Not reaching out could result in an almost 50% increased likelihood of switching.”⁸

The factors that encourage drivers to stay engaged with an insurer, share driving data, and demonstrate long-term loyalty are multi-layered and not always completely obvious. Insurers developing UBI programs designed to attract, retain, and deliver positive experiences to drivers need to think beyond discounts and incentives that do not always deliver on their promises and expectations. Gaining a clear understanding of customer expectations is a recommended starting point.

White Paper

Boosting Engagement and Capitalizing on Rewards

How to Make Insurance Telematics and UBI Fully Work.

Better engagement underlies increased adoption of usage-based insurance (UBI) and motivates customers to adjust driving behavior to achieve desired program outcomes.

³ Mahdi, Sean, Kieran Lesforis. This Time It’s Personal. Accenture. 2019. https://www.accenture.com/_ acnmedia/pdf-102/accenture-this-time-its-personal.pdf

⁴ Usage-based Insurance Market Size worth $115bn by 2026. Global Market Insights. November 2019. https://www.gminsights.com/pressrelease/usage-based-insurance-ubi-market

⁵ U.S. Auto Insurance: Increase Engagement with Personalized Advice Programs. Insurance Canada. February 2020. https://www.insurance-canada.ca/2020/02/18/aite-group-personalized-advice-programs-increaseengagement/

⁶ Usage-based auto insurance: a new technological dawn? Willis Tower Watson. May 2017. https://www. willistowerswatson.com/en-US/Insights/2017/05/usage-based-auto-insurance-a-new-technological-dawn

⁷McMahon, Lucian. J.D. Power Study on Insurers and Data: A Matter of Trust. Insurance Information Institute. June 2019. https://www.iii.org/insuranceindustryblog/category/customer-satisfaction/

⁸ Adriano, Lyle. Could insurers’ auto discounts be backfiring? Insurance Business America. April 2020. https://www.insurancebusinessmag.com/us/news/breaking-news/could-insurers-auto-discounts-bebackfiring- 220486.aspx