Executive Summary

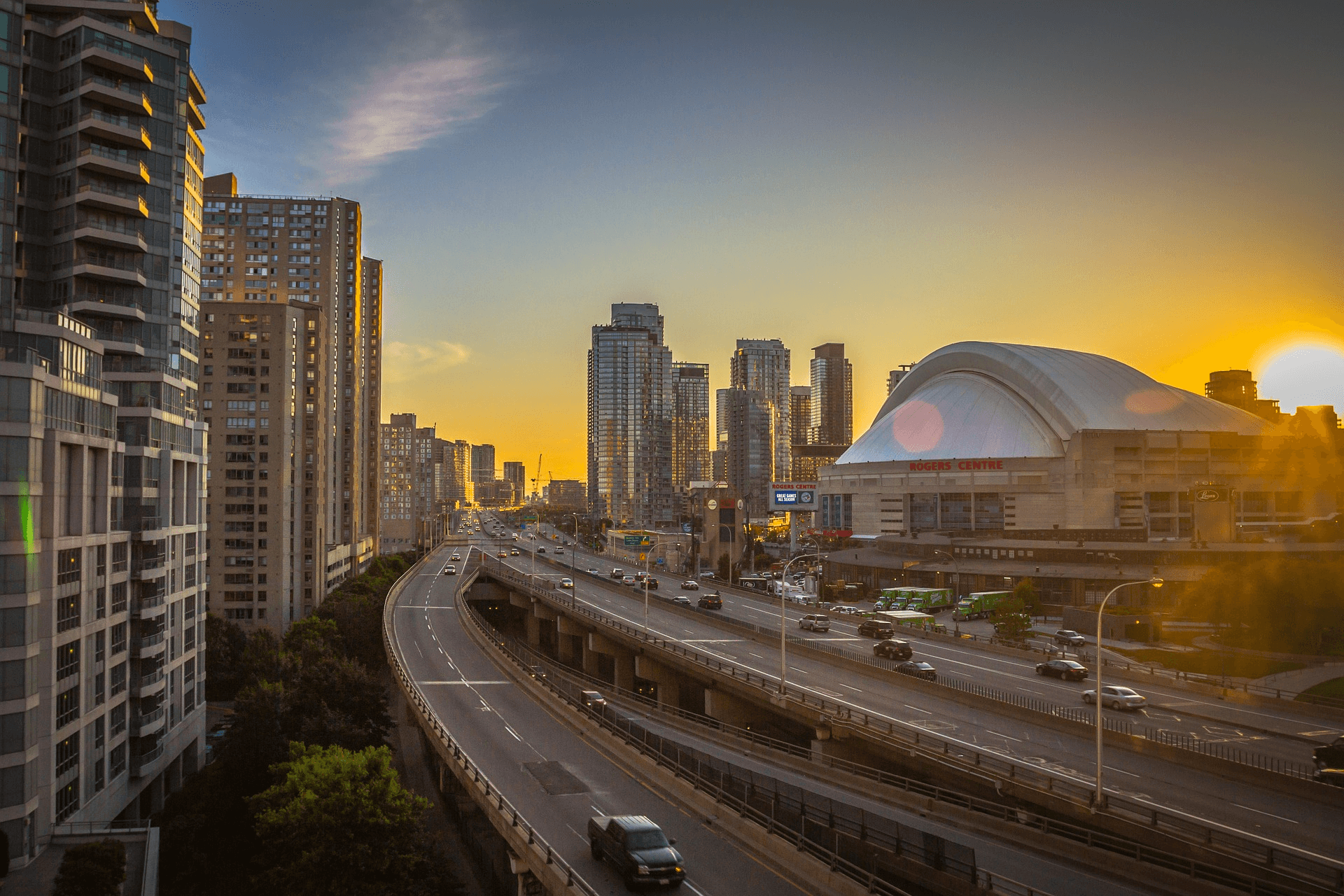

The past several years have been a wild ride, particularly for the insurance industry. As people are starting to acclimatize to the post-COVID ‘norm’, or at least an endemic situation which is more stable and manageable, massive changes are beginning to appear in the lifestyles of insurance policyholders. This is further exacerbated by global inflationary pressures on consumers.

What does this mean?

It means that understanding post-COVID driving patterns of policyholders both individually and en masse is critical to insurers returning to profitability in this post-pandemic world.

The need to understand current driving patterns of policyholders is intensified by the fact that traditional rating attributes – age, gender, marital status, credit, prior accident histories, continuous coverage, etc. – are all in flux as compared to pre-pandemic baselines. The best way to understand how individual policyholders’ mobility patterns have changed post-COVID is by getting real-time or near real-time data about when and how much policyholders are now driving.