Exploring the Advantages and Disadvantages of Mobile Telematics Data Collection

One of the most fascinating areas of growth is mobile-based data collection, or the use of smartphones to learn more about driver behavior. It’s no longer a secret: usage-based insurance (UBI) and insurance telematics are completely changing how the insurance industry functions with expected customer demands for UBI to grow over 140 million subscribers globally by 2023 and over $700 billion in revenue through car data monetization by 2030. Telematics devices installed in a vehicle allow an insurance provider to have more precise information to rate driver’s premiums such as on-road activity (including braking and cornering speed or acceleration), the time of day when driving, and the amount of time spent behind the wheel.

The advantages of smartphone telematics and Behavior-Based Insurance (BBI) programs are fairly obvious: insurance providers can identify and understand risks by gaining a more accurate glimpse of how their clients actually behave behind the wheel. They can also limit their exposure to risks through loss prevention techniques by understanding when and where clients drive, helping them determine who should be paying more, and who should be paying less, for automotive insurance.

So, what’s the best way to collect that data? Is the best solution OBD-II, mobile, or a hybrid option blending elements of the other two?

We believe there isn’t necessarily one right answer. Instead, any of these methods could work effectively, one may be better than another depending on the nature of the insurance program in question.

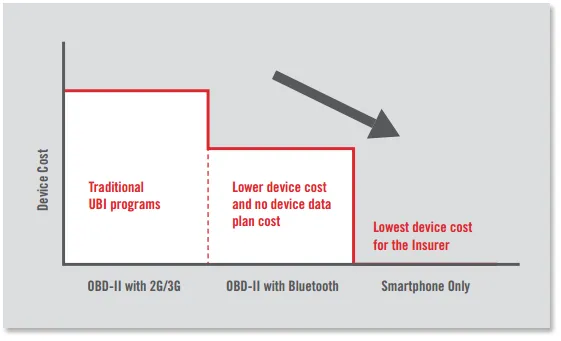

One of the most exciting options for telematics data collection is mobile, or the use of smartphones. There are a number of clear advantages to this system, starting with the elimination of hardware costs for insurers. Whereas OBD-II programs require the insurance provider to purchase and distribute telematics devices that clients can install in their vehicles, the mobile option employs a client’s own mobile device. And because smartphones are becoming essentially ubiquitous — meaning just about everyone owns them — it’s a system that can be easily and effectively implemented. (In terms of cost, also leveraging the user’s existing mobile data plan or wifi network – which is a very small data footprint due to techniques such as compression.)

Another great reason to consider smartphones and mobile SDKs for telematics data collection: because mobile-based software application distribution systems are so readily available and widely understood, it’s relatively simple for insurance providers to launch telematics-based programs for their clients. Custom/White-labeled apps provide insurance providers with an easy way to offer clients training, coaching, and advice. These apps can also open up unique lines of communication with drivers, thereby giving an insurance provider an opportunity to improve relations with clients.

There are other advantages to using smartphones for telematics data collection. First, many of today’s smartphones come equipped with built-in sensors that can be used to collect advanced telematics data. For example, many smartphones feature a precision global positioning system (GPS) receivers, accelerometers for reading G-forces, and multiple data connectivity mechanisms. In many cases, it’s a straightforward process to complement these capabilities with other sensors, such as magnetometers, proximity sensors, and ambient light sensors.

Another advantage of using smartphones for collecting telematics data: portability. Unlike many OBD-II devices, a smartphone can be moved between vehicles quickly and easily, allowing an insurance provider to collect data about a driver on multiple vehicles. There’s also no need to worry about compatibility, as smartphone solutions can be used with virtually any type of vehicle.

But there are some challenges for insurance providers exploring the mobile option. For one, unlike most OBD-II connectivity systems, smartphones rely on a number of different operating systems and platforms, from Android to iOS and beyond. These platforms can and do change, introducing significant challenges for insurance providers and their telematics systems. Changing connectivity standards on mobile devices can also make maintaining consistency in approach and design more difficult. It’s also important to remember that the mobile technology used for telematics data collection — like consumer-grade sensors — is not always designed with that purpose in mind. Finally, not all smartphones are built the same — while the newest versions of the Apple iPhone, Samsung Galaxy, and BlackBerry may be equipped with cutting-edge sensor technology, there are many devices on the market that lack this advanced hardware.

Some other issues, smartphones are mounted, so a smartphone that falls off a seat could register as a crash (which becomes a problem if this occurs often). Furthermore, because it’s not plugged into the vehicle, lose value-added services relating to vehicle health and vehicle-based services.

These challenges require insurance providers to employ complex algorithms that can normalize the data collected, stored, and analyzed through mobile platforms. Following the normalization of this data, insurance providers can use this information for a number of UBI programs.

The good news is that, even with these challenges, mobile-based solutions are extremely cost-effective. Mobile telematics offerings are also easy to roll out, which ensures customers remain comfortable with these programs.

We recommend that anyone interested in exploring data collection solutions contact an experienced, knowledgeable telematics provider. They can help you carefully evaluate the advantages and disadvantages of prospective telematics solutions, including OBD2, mobile, and a hybrid option.