Mobile Telematics Applications for Auto Insurance are Less Restrictive and Fit Within the Regulatory Frameworks in Many Regions.

By all indications, vehicles are quickly advancing beyond their primary role as transportation devices and are now becoming full-featured mobile communication platforms.

As a part of this global market trend, drivers can voluntarily transmit information about their driving behavior—to have their insurance premiums more accurately linked to their behavior—and they can also receive real-time feedback to reinforce positive driving habits and minimize risks during travel. Numerous other benefits result from improved communication, including maintenance reminders, social media interaction, weather and road-condition warnings, accident reconstruction, theft recovery, and more.

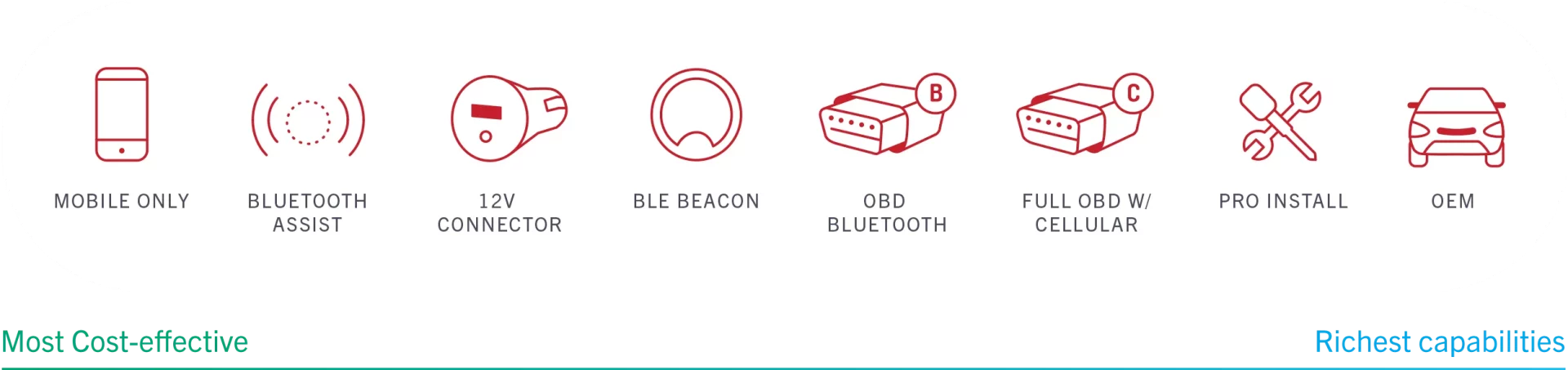

At the moment, telematics solutions based on OBD-II are leading the market in terms of sheer numbers. However, for select programs, smartphones (mobile telematics) are satisfying certain market requirements and establishing their own niche. Hybrid solutions are also gaining popularity because of their ability to capture rich vehicle data while offsetting some of the traditional costs of standalone cellular-based OBD options.

MOBILE TELEMATICS DATA COLLECTION GAINING MOMENTUM

Telematics data collection by a smartphone has been generating increased interest in the UBI sector. Hardware costs are eliminated for the insurer—since the approach relies on the consumer’s smartphone instead of add-on hardware. There are, however, a number of technological considerations that insurers should think about when selecting an experienced TSP for mobile solutions. Rather than the unified infrastructure surrounding OBD-II connectivity, smartphones today rely on several different operating systems and platforms, each of which can change at an accelerated rate as new phones are introduced. Collecting data from these individual platforms in a consistent manner to a central system can be problematic, particularly keeping track of the different versions of both smartphones and operating systems and adapting to their changing connectivity standards. Another consideration is that the consumer-grade sensors used in smartphones are specifically designed for phone applications, not telematics data collection.

The cost-effectiveness of smartphone-based solutions can provide an effective introductory telematics offering. Presenting data to the driver through the smartphone is also a natural and intuitive way to receive information, as well as to perform data collection and transmission. Recent advances in telematics data collection by leading TSPs have greatly improved or resolved many of the earlier issues, such as trip detection, vehicle identification and battery consumption.

MOBILE VS. OBD AFTERMARKET SOLUTION SUBSCRIBERS

By most indicators, OBD-II devices will still be a dominant presence in the market well beyond 2025. As shown in the figure to the right, ABI research predicts there will be 117.8 million subscribers to OBD aftermarket solutions by 2019.

Ultimately, it’s essential to work with an experienced telematics service provider that understands the full range of options and can help you assess the trade-offs in choosing the most appropriate in-vehicle technology to meet the specific segmentation goals of your program. OBD-based options, smartphone options, and hybrid solutions are not necessarily in opposition to each another, but can be complementary in meeting the diverse needs of a comprehensive behavior-based assessment program.

Cost savings can be a valuable consideration, but extended capabilities, data quality, and flexibility are important factors as well. OBD-based, smartphone-based, and hybrid telematics solutions have a place in the market, depending on the requirements of the insurers and the preferences and habits of the insured. Strong growth in each of these sectors seems assured.

The trade-offs among smartphones, hybrid, and OBD-II for data collection are largely linked to the overall objectives of a given insurance program and should always be considered in this context.

Some factors seem clear-cut on initial analysis, and they reveal greater complexity after more analysis. For example, the inexpensive initial cost (to the insurer) of smartphone data collection can be countered by the long-term trade-offs. In comparison, OBD-II solutions have a higher initial cost (to the insurer), but, since the hardware is fixed and stays in the car, additional costs over the term of the insurance program are less likely. Hybrid solutions provide data accuracy, and opportunities for value-added services, but require greater support by the insurer and more intervention by the policyholder to establish communication and ensure the data collection is taking place as needed.

Geographical considerations are also a factor. Regulatory bodies in the insurance industry set the standards by which a given technology will be accepted or rejected in each region. Legislative and regulatory bodies in some regions prefer one approach over another. For example, in the European market, mobile telematics solutions are less restrictive and fit within the regulatory frameworks in many regions.