Insurers are Rediscovering an Essential Truth: The Need to Provide Genuine Consumer Value as a Key Driver of Business Success

Digital transformation has dramatically disrupted a number of businesses across horizontal and vertical markets, spanning both business-to-business and business-to-consumer models. The telecommunications, healthcare, and financial services industries have seen adoption and significant changes as a result of digital transformation, but until recently the insurance industry has not been deeply drawn into the transformational vortex.

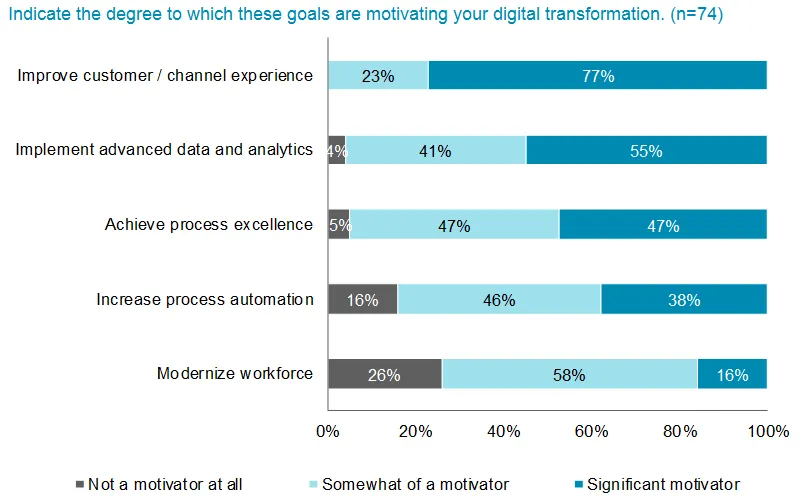

Today, however, the emergence of a host of InsurTech startups with many using emerging technologies, such as artificial intelligence (AI) and the Internet of Things (IoT) to offer deeper data insights and greater speed and efficiency of services to meet changing customer needs is quickly gaining the attention of the insurance industry. In a recent study by Celent, the digital transformation of the insurance industry is in full swing. Digitalization offers opportunities to improve performance and customer experience. It also continues to pressure firms to change, below are the key survey results-driving digital transformation in insurance:

Image source: https://www.celent.com/insights/127860288

How Have Insurtech Companies Changed the Insurance Industry and Which Insurance Fields are Affected the Most?

These fast-moving, digitally enabled Insurtech startups are identifying and capitalizing on the weaknesses of traditional insurers in fields such as Auto Insurance, P&C Insurance, Health/Travel Insurance, Life and Home Insurance with highly inventive value propositions for consumers. As a result, the entire industry is re-examining those areas in which weaknesses are evident and exploring innovative opportunities driven by new technologies. As a part of this process, insurers are rediscovering an essential truth: the need to provide genuine consumer value as a fundamental driver of business success as they transition to the age of digital innovation. According to Willis Towers Watson Insurtech investors worldwide executed the highest number of transactions with a total value of $1.41 billion in Q1 2019 and $1.2 billion in Q2 2019 alone with the greatest number of early-stage investments in Property & Casualty (P&C).

How Can Insurers Avoid Being Blindsided by InsurTech Disruption?

Insurers are continuously facing pressure to keep on top of emerging business models and technologies that are gaining traction within the startup community. Across the board, certain insurance processes that have been resistant to change for many years are becoming automated, and data-driven insights are eclipsing traditional metrics for determining rates and delivering services. But disruption is about more than technology, to avoid being blindsided by InsurTech disruption companies must not only adopt a farsighted strategy but align with InsurTech principles that emphasize agility, long-term technology investment, personalization, customization, and innovative services, based on a foundation provided by a dynamic, supporting ecosystem.

“ No one knows what the perfect new business models are because they haven’t been fully articulated or proven. To find sustainable revenue, firms will need to learn fast, fail fast, and partner as needed.” – Marie Carr, Global Growth Strategy in Insurance and Financial Services, PwC

What Does Digital Transformation Mean for Traditional Insurance Practices?

Auto, Property & Casualty (P&C), Life and Health insurance has always been such tightly-regulated industry where archaic application processes, underwriting inconsistencies and lengthy decision wait time have left customers with an extremely poor perception of the value of insurance. Currently consumer relationships with insurers are at an all-time low. The touchpoints that insurers establish with consumers are usually sporadic and insufficient to build a sustaining long-term relationship. Consumers may hear from insurers once a year about the renewal of their policy. Much of the time they don’t even understand the details of the coverage being provided.

The consumer research group of Ernst & Young LLP (EY) identified numerous trust and communication issues, outlined in the EY Global Consumer Insurance Survey, highlighting high turnover rates and poor consumer relationships with insurers. Only 14 percent of consumers indicated that they were very satisfied with the communication received from insurers. Another 44 percent stated that they had not had any interaction with their insurers in the prior 18 months. One key finding of this survey reflects on the InsurTech surge: 80 percent of consumers are willing to use digital and remote channel options for different tasks and transactions. Digital technologies, with their broad reach and ready adoption by younger consumers (and increasingly by older consumers) offer a powerful channel to deliver on-demand services while enhancing communication with insurers and building trust.

Where Is Disruptive Technology Taking The Insurance Industry?

The future is evident, InsurTech is reshaping the way insurance services are structured and this trend will likely continue as there will be increasing complexity in consumer purchasing decisions. Most insurance companies believe they can “disrupt” the insurance industry by just adopting emerging technologies, this alone does not guarantee success but a focus on increased personalization, right business model investments and improved efficiency of services to meet changing customer needs is paramount. Thanks to big data insights, insurers costs will also begin to decrease as new ways of doing business evolve – McKinsey states, that going ahead, insurers will play more of a risk avoidance role, as compared to that of a risk mitigator.

New concepts for determining insurance rates and automating the management of billing and claims are springing up as organizations, using algorithms and a data-driven approach are establishing more frequent contacts with customers and building transformative technology-based relationships that are more enduring.

According to Accenture, 96% of insurers think digital ecosystems are having an impact on the insurance industry. By reducing the role of the broker and changing the traditional means of calculating rates, this new generation of technology-oriented insurance service providers are often able to cut the cost of insurance by nearly 50 percent. As an example, one enterprising insurer, Metromile, has created a pay-per-mile program in which customers are only billed for the actual miles driven. For low-mileage drivers, this can substantially cut their yearly expenses, based on the fact that one of the leading risk factors for drivers is how frequently they are on the road. Metromile is now also partnering with rising tech leader Uber to provide personal car insurance for Uber driver partners, carving this niche in the market ahead of larger insurance organizations.

Who are the top participants in the insurtech space and how does it affect insurance brokers?

The top 10 disruptive technology companies capitalizing on InsurTech innovations are:

|

Lemonade – Offers renters and home insurance policies for homes, apartments, co-ops and condos | |

|

FitSense – Provides assistance to life and health insurers that want to take advantage of data from wearable devices | |

|

bimaAFYA – Connects low income populations with health insurance in sub-Saharan Africa | |

|

MassUp – Uses application program interfaces (APIs) to link retailers and insurers, providing instant point-of-sale coverage for purchases | |

|

buzzmove – Enables consumers to inventory and insure belongings through a mobile app, and provides moving companies with accurate data about household contents | |

|

Cuvva – Offers flexible insurance subscriptions using a pay-as-you-drive model | |

|

Slice – Provides on-demand insurance to protect homeowners who are engaged in homesharing services | |

| Root – Insures only good drivers based on a driving evaluation performed using a smartphone app; lets customers design their own coverage and pay using the app | ||

|

Trov – Offers technology for consumers to catalog their insured belongings | |

| Domotz – Provides a platform, powered by the Internet of Things (IoT), for rating insurance risk and managing claims |

The business operations of these organizations will likely take different paths. Some may be acquired by larger insurance firms that recognize their adaptive approach makes good business sense. Some may forge alliances and become bigger, more powerful conglomerates. But one thing is certain: They will have a large-scale impact on the overall insurance market. Andrew Simpson, covering the story for the Insurance Journal, attended the first InsurTech Connection Conference, which drew approximately 1,500 entrepreneurs, investors, and insurance executives to Las Vegas. Simpson offered his observations:

“ The participants discussed how technology is already changing the insurance industry and shared their ideas for transforming it even further through technology. They talked about disrupting every link in the insurance value chain, digging deep to extract costs, improving the customer experience, maximizing transparency, simplifying all processes, lessening friction, empowering and delighting customers, minimizing moral hazard and fraud, employing Big Data, and even making the claims process pleasurable.”

The author notes, however, that despite the anticipated major disruption, insurance agents and brokers will be around for many years to come. Those most likely to prosper in the rapidly changing environment will be the ones in those lines and areas where they can serve as trusted advisors and find ways to add value to insurance offerings.

In their effort to grab market share from traditional insurers, many InsurTech startups and big tech firms are making commitments to better understand their customers and prospects. One of these startups—NewYork based Lemonade—has a behavioral scientist on staff, Daniel Ariely, to polish the rough edges off an industry that Ariely himself views as antagonistic and annoying.

Honesty and trust need to be re-emphasized, Ariely believes, to reinvent the business model for the insurance industry. In an article for the Insurance Journal, he is quoted as saying:

“If you tried to create a system to bring out the worst in humans, it would look a lot like the insurance of today. We’ve spent recent years deepening our understanding of honesty and trust, and our conclusion is that insurance is crying out for a makeover. With its unique business model and technology, Lemonade aims to reverse the adversarial dynamics that plague the industry, transforming both the economics and experience of insurance.”

What Regulatory Hurdles Do Insurtech Companies Face in the USA?

Clyde & Co’s recent Insurance Growth Report found that regulation is one major part of the challenge facing InsurTech’s. With the United States being a huge lucrative marketplace for InsurTech entrepreneurs and enormous pools of venture capital the U.S. state-based system of regulating insurance on how insurance is marketed, sold, underwritten and administered creates hurdles and complexity.