Insurance in the Digital Age: Key Digitization Trends Changing Insurers’ Future Approach to Claims

There’s no denying that the property and casualty (P&C) industry and business model has rapidly changed with the cost of insurance claims raising year on year, and in many cases, consistent high loss and combined ratios. With the rise of digitalization in business, powerful new digital approaches has given insurers new tools for automating their processes and more importantly determining who, and what, represent the greatest risks and costs to their customers and their bottom line. The growing availability of data, enabling the advent of concepts like usage-based insurance (UBI) is steadily redefining how one acquires insurance and how their premiums are determined.

The proliferation of data sources has given insurers a clearer picture of their customers’ needs and behaviors. It also offers insurers an opportunity to improve their handling of a very sensitive topic: claims.

Let’s get started:

- Claims Ecosystem: A Classic Balancing Act

- Can Digitization Radically Reinvent the Claims Customer Journey?

- Enhancing the Customer Experience is Essential for Ambitious Insurers to Build Personalized, Long-lasting Relations with Policyholders

- Conclusion

1. CLAIMS ECOSYSTEM: A CLASSIC BALANCING ACT

In the past, insurers faced a tough balancing act in trying to provide customers with excellent customer service – represented by a calm, reassuring demeanor and rapid claims processing and payouts – with a careful eye on the threat of fraud. Because fraud is both prevalent and costly, many insurers tilted towards fraud protection, sometimes at the cost of satisfying their customers. Imagine, for a moment, being in a traffic accident that isn’t your fault. You’re upset, you’re worried about the time it will take to handle the matter, and maybe you’re nursing a physical injury. You want, and need, help to get the matter resolved and put it behind you.

If you’ve been with your insurer for a few years, you have every right to expect great, friendly service and fast processing of your claim. But insurers have to make sure the claim isn’t fraudulent. So, they take their time reviewing it before moving ahead with processing. If anything appears out of order, the insurer investigates further. It’s understandable from the insurer’s point of view, but it has the potential to destroy years of loyalty built up between the insurer and the customer in question. This is because, from a customer’s point of view, they’ve invested in the relationship through their premiums and feel that, when a claim is being made, they’re owed great service and support.

Arguably, the result of the insurance industry’s approach to claims has been a growing mistrust of insurance providers and the industry as a whole – something that may prove far more costly than a few missed fraud cases.

2. CAN DIGITIZATION RADICALLY REINVENT THE CLAIMS CUSTOMER JOURNEY?

The good news is that digitization offers insurers a way back into consumers’ good graces without having to let their guard down on fraud. For one, automotive telematics technology – which is being embraced by a growing number of insurers and consumers – allows insurance providers to learn more about the circumstances surrounding a claim. Other useful technology available in many vehicles includes sensors, cameras, accelerometers, global positioning systems, and gyro data can all give insurance companies the information they need to create an accurate picture of a traffic event.

When this technology is used, insurers gain access to critical information about a traffic accident, including when and where it took place. They’re also privy to information about the vehicle, like how fast it was traveling. Together, this information can help insurers compile a comprehensive picture of how an accident took place and then use that account to cross-reference what they’ve been told by those involved, including the customer.

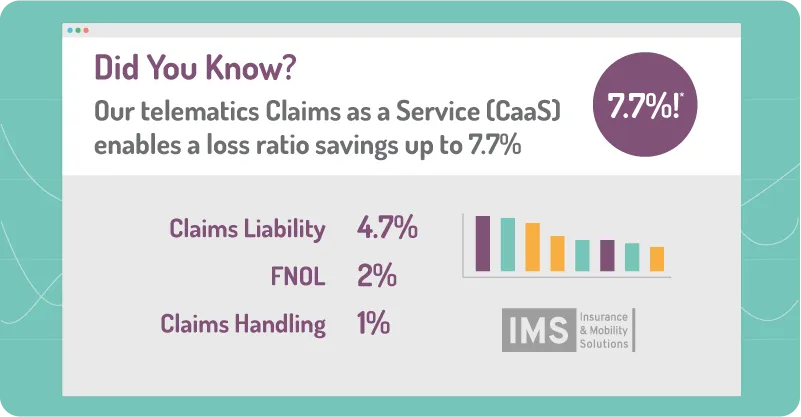

Beyond that, the growing list of blockchain, chatbots, machine learning, AI, Claims as a Service, FNOL and telematics-oriented technologies available to insurers allows them to be proactive in helping a customer get started in processing a claim and getting back to normal. Rather than waiting for a customer to make a claim, they can reach out to them to ensure the customer has what they need to get their vehicle repaired and back on the road. It’s a huge opportunity for insurers to reduce costs of administering claims and to build their brand; for those companies at the forefront of putting this approach into practice, they may be able to shift market dynamics in their favor, giving themselves a leg up on their nearest competitors.

This differentiation is happening as we speak. Currently, a new approach and one of the more popular trends in the insurance industry is the overhaul of legacy information technology (IT) infrastructure. In the highly conservative insurance industry, it’s not surprising these IT platforms are dated and in desperate need of updates that bring insurance providers onto the same level as their counterparts in banking. And with consumer needs constantly evolving – thanks in part to advances by said banking counterparts – it’s hard to blame insurance providers from focusing their attention on updating IT systems.

But it would be wrong to assume that overhauling legacy IT platforms stands opposed to incorporating digital technologies like telematics. In truth, they’re complementary, and forward-thinking insurers should be making digitization, and specifically telematics implementation, a key part of their transition towards newer IT systems and developing a new digital value proposition. Take, for example, the opportunities for an insurer presented by adding a digital claims process – by building this into a new IT system, an insurer can strengthen claims management, speed up the processing of claims and use the data collected to learn more about their customers and their preferences. When this results in greater efficiency, it has the potential to drastically improve the insurer-customer relationship.

3. ENHANCING THE CUSTOMER EXPERIENCE IS ESSENTIAL FOR AMBITIOUS INSURERS TO BUILD PERSONALIZED, LONG-LASTING RELATIONS WITH POLICYHOLDERS

And this is really what moving towards a digital approach is all about: making the process of acquiring insurance, and then interacting with an insurer, easier and more efficient for the customer. While many insurance companies boast that the customer is at the center of everything they do, in reality, that claim isn’t always authentic.

In many parts of the industry, and perhaps most in the areas of wealth management and life insurance, it’s the insurance advisor or agent that remains the focus of an insurer, not the customer. In this environment, the assumption is that customers want person-to-person interactions and remain fundamentally less interested in digital services. And while this may be true in certain scenarios, such as when a high-net-worth client is seeking financial advice they can easily afford, for a growing body of consumers it’s neither convenient nor cost-effective.

At the same time, a growing number of consumers feel comfortable using digital platforms for these kinds of purposes. Banks everywhere are shifting their service options in major ways as the popularity of online banking soars at the cost of in-house staffing. In insurance, digitization offers customers the opportunity to get started on what can be a lengthy policy application process without having to make their way into an advisor’s office.

That said, many insurance providers can be forgiven, however slightly, for remaining hesitant to embrace digital processes. After all, the process of applying for a policy is often very complicated and it’s important that every customer fully understands what they’re signing up for. That’s why it’s crucial for insurers to recognize that simply transitioning established and traditional application methods to digital ones isn’t enough. They need to make sure that digital customers understand the process just as much and that means implementing processes that meet the needs of all applicants.

This is where data collection can be so helpful in the development of a truly innovative customer journey. Digitizing data allows an insurer to automate processes that can save time for a customer – for example, by helping them get started on a claim shortly after a traffic accident occurs. As the availability of data increases through the use of smartphones, health tracking technology, GPS, smart meters, security platforms, etc., insurers can begin to streamline their responses to customers, with each individual receiving communications tailored to their unique needs.

4. CONCLUSION

Today, we stand at something of a crossroads for insurance providers and consumers alike. Insurers are currently weighing the benefits of overhauling their service offerings, unsure that a fundamental shift away from in-person interactions will benefit them in the long term. Meanwhile, consumers are gaining confidence and trust in providing insurers with the personal information required to make digital interactions truly convenient, affordable, and effective. A study conducted by ISO found that for every accident the average cost to an insurer can range from $1,671 for a comprehensive claim to $17,024 for an auto liability claim for bodily injury. And, in the case of a car accident resulting in a fatality, the overall cost increases to an average of $504,408 – half of which the insurer has to pay.

Ultimately, the future path to successfully reducing costs and increasing revenues is creating an innovative customer journey, optimizing the claims process to reduce claims leakage and mitigating the risk of insurance fraud by leveraging emerging digital technologies. Digital transformation (DX) holds tremendous potential for client-centric insurance providers to not only increase customer satisfaction and accelerate closure time for claims but differentiate their business from their competitors in the market.