The process of handling auto insurance claims has long been riddled with inefficiencies. Yet the investment required to streamline the claims process could be significantly smaller than you think, thanks to the power of modern telematics and connected car data. In this article we look at the three key challenges and explore possible claims management solutions.

Right now, claims costs account for almost 80% of policyholder premiums, yet many insurers rely on manual processes that lack the power to effectively record claims details and cost a lot of time and money. In this post-pandemic world, times are changing, and insurers are needing to transform their processes and digitalize the way they collect data from their customers. This is where digital transformation and telematics comes in to help. With telematics data and a full understanding of the way it can positively impact the claims process, insurers can reap the benefits on faster and more cost-effective claims handling. In this article, you will dive deeper into the challenges insurers are facing and gain understanding and insight into how telematics and connected car-based solutions can help solve these challenges.

The solution could be simpler than you think

Telematics and connected car data offer fantastic insights and ways to help generate cost savings immediately and directly. With limited investment, it can deliver quick, measurable improvements in three key claims handling areas:

- Claims liability – The prompt, accurate establishment of liability

- Claims shelf-life – The speed with which a claim can be processed

- First Notice of Loss/Accident Detection – Real-time accident notification

Let’s look at each one of these areas in turn.

Challenge 1: Claims liability

Identifying who is at fault when a claim is made can be complex – which is why it is an area rife with fraudulent claims. There are enormous benefits to be realized here, because liability claims – especially for fleet operations – can increase operating costs significantly. For a competitive insurance operation, minimizing these costs is critical.

How intelligent claims management can improve this process

Telematics makes it possible to determine liability and identify fraud because of the rich data it provides. This data can be used to visualize and contextualize the precise sequence of events that took place when an accident occurs.

Although not all courts in all regions accept telematics data at present, it is already being used in many territories to accurately establish the circumstances of an accident. Court cases in North America and Europe have used g-force data, for example, to indicate fraudulent accident claims and inflated claims for bodily injury. Vehicle route recordings have been used to catch fraudulent claims or indicate that unsafe driving was detected prior to an accident. While only a small percentage of claims ever go to court, telematics data can also be used to achieve a cost-effective out-of-court settlement.

Challenge 2: Claims shelf-life

Time is money in any business – and in insurance, nowhere does it become more apparent than in the end-to-end duration of the claims process. To put it simply, the longer a claim goes on, the more costly it will be. A current challenge is automation and speed as many insurers still use manual claims processes – albeit many auto insurers have quickly moved to virtual processes and automation as a result of the pandemic. Legacy, outdated processes can lead to multiple delays in determining fault, detecting fraudulent behavior and can ultimately slow down the process significantly. And while there will always be expensive, complex cases, it should be possible to process claims quickly, easily and accurately. That means automating as much as possible while also using data and insights to intelligently inform the claims process along the way.

An additional benefit of a faster, smoother claims process is the quality of the customer experience. Making a claim is always the moment of truth for a policyholder. For many, it’s the only time any discernible service is provided. So, the faster you can process a claim, the more likely a customer will be to stay with you. According to consultancy EY, 87% of policyholders felt that the claims experience was a major reason to remain with an insurer.¹

How to improve claims handling

Reducing the shelf life of claims is an important factor in creating a more favourable loss ratio for insurers. By introducing vehicle data into the claims process, as well as for evidence to support a claim, it is possible to cut days from the total claims process time.

According to data we’ve compiled, connected car data has led to a 60% drop in the claim life cycle in cases involving low-speed collisions and soft tissue injuries. In cases of mistaken identity, claim shelf life can be reduced by 80%, by using data to prove the location of the tracked vehicle. In fact, telematics and connected car data has led to a reduction in touchpoints across the entire process by 30%, boosting efficiency and reducing friction for the customer.

Claims handlers and adjusters can also benefit, by simplifying and unifying processes that were formerly managed manually. Back-office processes can also be improved (e.g. verifying repair estimates and generating prompt reimbursements).

Challenge 3: First-Notice-Of-Loss/Accident detection

Generating FNOL and accident detection relies heavily on the people involved letting their insurer know there has been an accident and providing all the information about the collision. This is often a long-winded process and leads to the insurer losing money and having minimal control over the claims process. With the manual process of collecting evidence, information, determining liability and ruling out fraud, it can take weeks, if not months to settle a simple claim dispute.

Not only can it lead to delays in an outcome but relying on manual processes can cause a delay in notifying emergency and recovery services and inaccuracies in incident details, which can lengthen the entire claims process and cost more money.

How telematics-driven claims tracking can help

Generating First-Notice-of-Loss (FNOL) alerts electronically and instantly through telematics is a proven time-saving and money-saving way to assist policyholders when communicating with their insurer, as well as emergency contacts and tow services.

Incorporating telematics can help notify insurers of an incident instantly through impact alerts which automatically speeds up the claims process. Not only does the instant impact detection start the process quickly, but incorporating more digitalized technology alongside telematics, such as an app to accompany it, policyholders can be alerted of their incident and send live information and images from the scene of the incident. Notifying policyholders early can also help the recovery and tow process by dispatching tow trucks quickly and ensuring damaged vehicles are delivered to the correct service depot the first time – avoiding costly return pick-ups and rerouting.

The contextual data captured through telematics devices— including accelerometers, gyroscopes, impact, location etc can be used by the insurer to show an accurate story of what happened and accurately determine fault within minutes. Using telematics gives the insurer automatic insights and significantly more control over the process rather than having to wait for the claimant or those involved to submit all the relevant information manually. A claim can be cut in half, if not more with the use of accurate data which in turn saves on an abundance of claim related costs.

The claims process: traditional versus telematics-driven

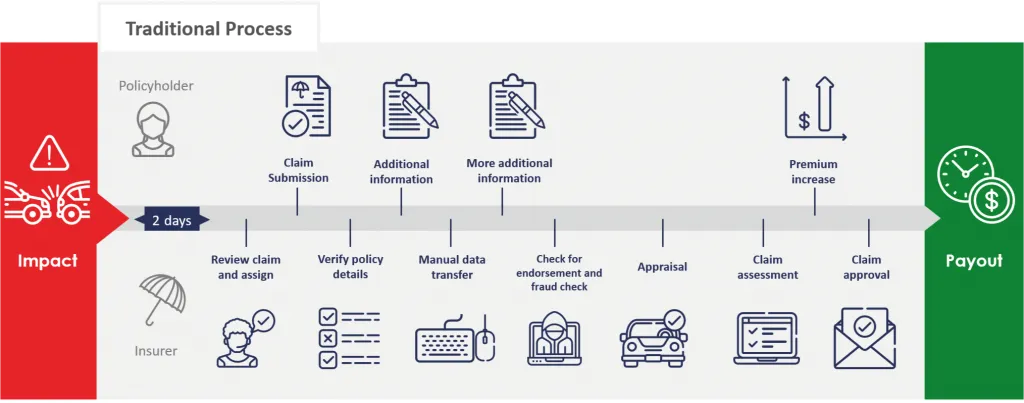

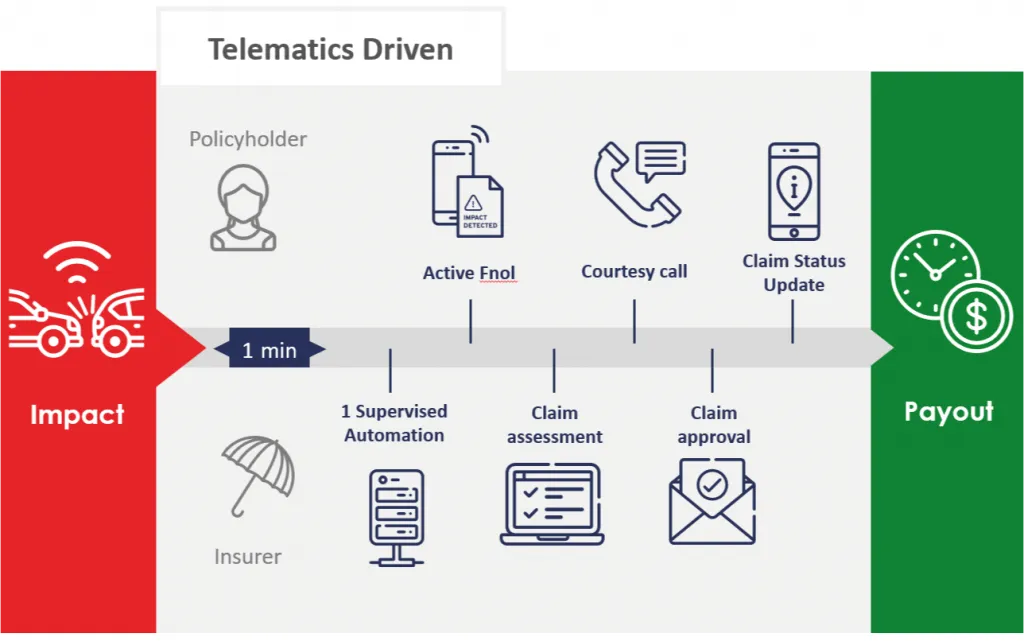

Digital transformation can be something that touches all areas of insurance in a way that it changes the way we do business today and tomorrow, by adopting a telematics-driven claims process, insurers can make great gains in cost savings, profitability, and more satisfied customers. Take a look at how the traditional claims process compares to a intelligent telematics data-driven claims process – and the overall combined areas of process improvement which are possible.

Traditional claims process

Telematics-driven claims process

These diagrams reveal the drastic differences in claim handling times associated with the introduction of telematics. Using telematics within the claims process means automatic crash alerts (FNOL) as well as automatic evidence of speed and impact, which in turn results in a speedy overall claims shelf life and a corresponding improvement in customer satisfaction.

Anticipating the future of claims

Upheavals and uncertainty across the world, spurred by climate disruption and a viral pandemic, have fostered a deep rethinking of many fundamental business processes. Today, we’re seeing more detailed information being collected from crash events that provide additional context to incidents. Data can be captured from a variety of sources, including telematics devices installed in the vehicle, self-powered devices tethered to a smartphone, or, in some cases, direct OEM-embedded vehicle sensor data. With a wealth of data captured and relayed for analysis, event reconstructions can be generated for an accurate visualization of the crash. As insurers gain experience with the capabilities of telematics and discover the positive benefits to short-term ROI and overall cost savings, the opportunities for additional areas of claims transformation will no doubt become apparent.

About IMS

IMS (Insurance & Mobility Solutions) is a vehicle and driving data business, delivering enterprise solutions to over 350 customers including mobility operators, insurers and governments. IMS launched its Vehicle Data Exchange, which enables the IMS DriveSync platform to ingest and process data from any source – from OEM embedded units to smartphones and aftermarket hardware. The company, with offices in the UK, Europe and North America, has analyzed more than fifteen billion miles, feeding its algorithms with over a trillion data points.

About IMS Connected Claims Solution:

IMS Connected Claims is a low-cost suite of telemetry-based services that transforms collected telematics data into appropriate analysis that positively impacts the policyholder experience and an organization’s claims costs. The solution includes hardware, ongoing training and implementation consulting, along with expert support services.

Find out more: https://ims.tech/claims/

Learn More Download Additional Resources:

Datasheet: IMS Connected Claims Solution

Datasheet: IMS Wedge Bluetooth Low Energy Beacon

White Paper: Improving Claims ROI and Claims Operations with Telematics Data

¹ Claims in a digital era: Data, analytics, and AI transform the customer experience, EY Global 2017: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/insurance/insurance-pdfs/EY-claims-in-a-digital- era.pdf?download