The amount of data generated by road vehicles has grown exponentially in recent years – yet that doesn’t mean using it has always been cost-effective. Now, things are changing for the better. With recent advances in data collection, aggregation and provision, the question is no longer whether you can afford to use vehicle data, but whether you can afford not to.

Cars Have Been Collecting Data for More Than a Century

Road vehicles have been generating data for more than a century. It’s a story that began back in 1903, when Arthur and Charles Warner installed the first odometer in a car. It was a basic instrument, using the motion of the wheels to give a reasonably accurate report of the distance travelled. Crucially, it stored the data too, creating a cumulative record over time of the mileage covered by the car.

For decades, that was as complex as vehicle data got. Cars recorded their mileage and stored that data in the odometer itself, usually displaying it on the dashboard. In time, the addition of microelectronics meant that data could be used by trip computers. The addition of ECUs and sensors throughout the car led to more data being collected – providing access to diagnostic and servicing information. Then came satellite navigation and the collection of GPS location data.

The age of the connected car began with aftermarket telematics – black boxes added to the car, often as part of a usage-based insurance (UBI) policy held by the owner. In time, smartphones introduced a number of built-in sensors and capabilities that equipped them to collect data for telematics analytics. Limitations in vehicle identification and trip detection meant that additional sensors were still required, however, such as Bluetooth-enabled plug-in and brought-in devices. Then came OEM vehicle telematics data, as vehicle manufacturers began to build these capabilities in at the point of manufacturing. As a result, there are now two key sources of connected car data – aftermarket devices that have been fitted to vehicles retrospectively and the systems in cars that have been built with embedded telematics capabilities.

How Connected Car Data Has Evolved

The data typically available today can be grouped according to two categories: aftermarket data and OEM data.

Aftermarket telematics data

The introduction of vehicle telematics data was made possible thanks to black-boxes and on-board diagnostics (OBD) devices that were fitted or self-installed after production, enabling the vehicle to transfer data back to base. For insurers, the availability of this data, coupled with advances in telematics and in-vehicle technologies, changed the game. Personal and commercial lines insurers were now able to introduce usage-based insurance (UBI) and mileage-based (pay-per-mile) products with the potential to lower their costs. Governments, meanwhile, could start to explore road usage charging (RUC) as an alternative revenue opportunity, to help fund transportation infrastructure projects.

OEM telematics data

As mobile connectivity improved with the arrival of 3G and 4G, cars gained the ability to transmit much more data. This trend coincided with an increase in the collection of data onboard new vehicles, as their manufacturers introduced more and more digital features. With no aftermarket device installation required, the collection of vehicle data was now even more accessible and, in several use cases, more affordable and cost-effective.

Not all new vehicles were equipped with the same digital capabilities, however – and standards governing the type and format of vehicle data were never agreed. The only solution was to continue combining data from embedded and aftermarket devices.

By this point, availability of data was no longer the problem. Now it was the amount of vehicle and driving data – and the expertise needed to draw reliable insights from all the different sources.

The future: EV, ADAS and V2X data

As we move into the era of internet connectivity and big data, even more types of information are coming to the fore.

The growth in electric vehicles (EVs) has brought an influx of new data concerning the locations and rate at which their batteries are discharged and recharged – and the health of those batteries at any given time. Nearly all EVs include systems that inform the driver about locations of charging points – and many will calculate the best route to the next one. Some will even optimize energy consumption to ensure the vehicle makes best use of its remaining charge as it drives to the next charger. Much of the data generated by these systems can potentially be put to use – either commercially or as part of a plan for smart city infrastructure.

In time, ADAS and V2X data will grow in importance. ADAS is short for Advanced Driver Assistance Systems, which includes everything from autonomous parking to advanced cruise control and various safety systems. V2X incorporates vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I). As we enter an age where cars communicate with others nearby on the road, or with computerized road infrastructure such as traffic lights and traffic flow control systems, these are just a few types of data that can be generated and leveraged.

What Makes Connected Car Data So Important?

Connected car data opens up a wealth of opportunities for businesses with fleets of vehicles to improve their operations. For insurance companies, it can transform business models and the insurance experience.

Connected car data can be classified according to three broad ways you can make use of it: descriptive analytics, predictive analytics and prescriptive analytics.

Descriptive analytics

Descriptive analytics describes the use of data on the moment-by-moment driving habits of people in connected cars. By knowing where a car is driven from and to, for how long it has been driven for and how fast, a great deal of business information can be gleaned. The data can be linked to behavior – and action can be taken accordingly. For example, insurance policyholders who drive at the correct speeds can be contacted with rewards that incentivize them to keep driving safely. Delivery drivers can be encouraged to remain within speed limits. New products or communication campaigns can be created based on previously unknown driver behavior.

Predictive analytics

By analyzing the past behaviour of drivers, you can make predictions on their likely behaviour in the future. Rather than waiting for drivers to exhibit risky behavior, for example, you can create segments of drivers with the same data-driven profiles and characteristics as those who have already proven to drive unsafely. These drivers can be considered higher risk and treated differently to the rest.

Prescriptive analytics

Unlike descriptive and predictive analytics, which observe driver behaviour and give you the tools to plan a response, prescriptive analytics involves responding in real time to the behaviour of vehicles and drivers. For rental, service and leasing organizations, this can mean real-time access to mileage and vehicle health information. This data can be used to optimize the customer experience. For example, a car leasing business could detect and act on a vehicle fault before it is noticed by the customer, improving their experience and potentially reducing repair costs.

The Sheer Volume of Data Is Exploding

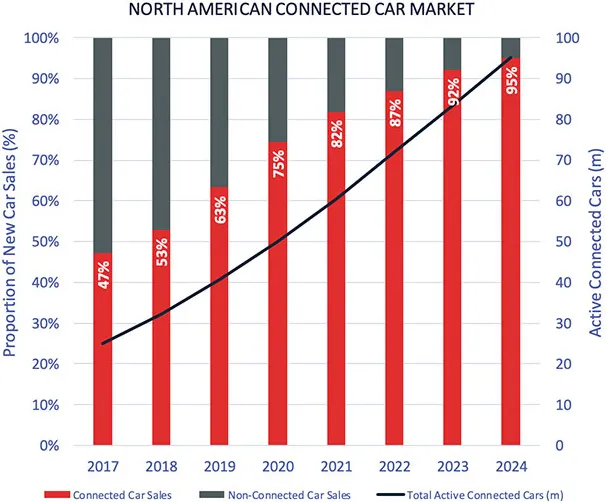

It stands to reason that the more vehicles there are that can share data, the more useful that data will be. According to Berg research, there are already more than 50 million connected cars on the road, including older vehicles with aftermarket devices. As for new vehicles equipped with the most sophisticated data-sharing features, they already represent more than 75% of all new car sales. By 2024, that figure is predicted to rise to more than 95%¹.

In the connected car world, nothing is standard

In short, cars are now connected. But that doesn’t mean that monetizing car data is simple. For insurers, mobility operators and governments looking to use the data they generate, that process has steadily become more complicated. Devices differ. Formats differ. Even the data fields and units used differ. Complexity comes with the territory. And where there is complexity, there is cost – or so you might think.

Putting Connected Car Data to Use

One way to monetize connected car data is to build direct partnerships with auto manufacturers, plus an in-house systems integration team with the IT infrastructure necessary to collect, integrate and process the data itself – and to do so while observing all necessary security and compliance protocols. But even the largest organizations can stumble – often because their focus is on delivering value via the customer experience, rather than running a data insights and mining operation.

The best alternative is to enlist the services of a third-party vehicle data exchange run by an experienced telematics service provider (TSP). Without the right data collection strategies in place, you risk missing critical insights that could prove beneficial to your business. The right partner can offer a huge amount of the real-time vehicle and driver data generated in the connected car universe – enabling you to cut costs, avoid risk and streamline operations.

About IMS

IMS is a vehicle and driving data business delivering connected solutions to global insurers, mobility operators and governments. Our People-Powered Technology™ enables innovative risk-based pricing, customer engagement, behavioral modification and claims management, supported by our unrivalled industry experience and proven customer success. With offices in the UK, Europe and North America, IMS captures and analyzes over 1 billion kilometers, 22 million driving hours and 80 million trips per month through our fully data-source agnostic IMS DriveSync® platform.

To learn how IMS can help your organization with real-time connected car data, visit https://ims.tech/vdx/.